Dear Capitolisters,

If there’s one thing on which almost all Republicans and Democrats have long agreed, it’s that “offshoring”—U.S. manufacturers’ investment in overseas production facilities—is Bad. It harms our manufacturing base and reduces industrial capacity; it kills jobs; and it undermines innovation—a particularly big problem given the ongoing Tech War (er, Competition) with China. Google around for a quick sec, and you’ll find no shortage of op-eds, press releases, and campaign speeches decrying the scourge of offshoring—usually by targeting a specific and recently newsworthy instance (e.g., Carrier in 2016)—and promising a range of policy proposals to discourage or reverse it. Our most recent presidents have, of course, made offshoring and reshoring centerpieces of their campaigns and policy agendas, but plenty of other White House inhabitants and aspirants have done the same.

The trouble with their narrative, however, is that, as shown in a great new paper, it’s almost entirely wrong. Instead, efforts to “bring back” overseas manufacturing might actually end up hurting some of the country’s biggest and most innovative manufacturing companies—and the American workers who fuel them.

The Realities of Global Manufacturing … and Innovation

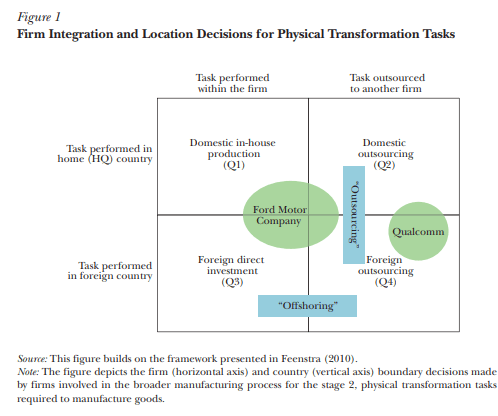

A new paper, by Dartmouth economist Teresa Fort, uses a novel dataset of U.S. multinational companies to bust a lot of myths about the relationship between trade, investment, production, and, most importantly of all, innovation. She starts by correcting a common misperception about what “manufacturing” even is—not merely production/transformation, but also pre-production design and innovation and post-production sales, marketing, and distribution—and then divides these manufacturing activities into four quadrants based on where work is undertaken:

A lot of offshoring discussion treats companies as operating in only one of these quadrants—domestically or abroad; in-house or outsourced—but many U.S. manufacturers operate in all four simultaneously. Fort provides two well-known examples: Texas Instruments and Ford Motor Company. The former, a semiconductor manufacturer, works extensively with outside contractors but also owns and operates several manufacturing plants (“fabs”) in the United States and 11 others in Mexico, Europe, and Asia. Ford, meanwhile, has many contract manufacturers and operates 20 of its 30 global manufacturing plants abroad.

We also tend to ignore a relatively new category of “manufacturer” that doesn’t own any actual factories—at home or abroad—but is still very much involved in all stages of manufacturing. Fort gives three examples of these “factoryless goods producers”:

Apple is deeply involved in manufacturing physical goods, but does so by means of third-party contract manufacturing suppliers primarily in foreign countries. Similarly, Nike reports 640 manufacturing locations across 38 countries, all of which involve outsourced relationships with contract manufacturers. Qualcomm is one of many “fabless” semiconductor firms that design chips and rely on predominantly Korean and Taiwanese contract manufacturers for their production.

Politicians and pundits get upset about only the bottom quadrants Q3 and Q4 (even though “domestic offshoring”—sending work to lower-cost regions within the U.S.—is very much a thing and can have similar effects), arguing that American companies’ foreign offshoring of production operations—whether to in-house affiliates (Q3) or unaffiliated producers (Q4)—undermines U.S. output, employment, and innovation. But they’re wrong on several levels.

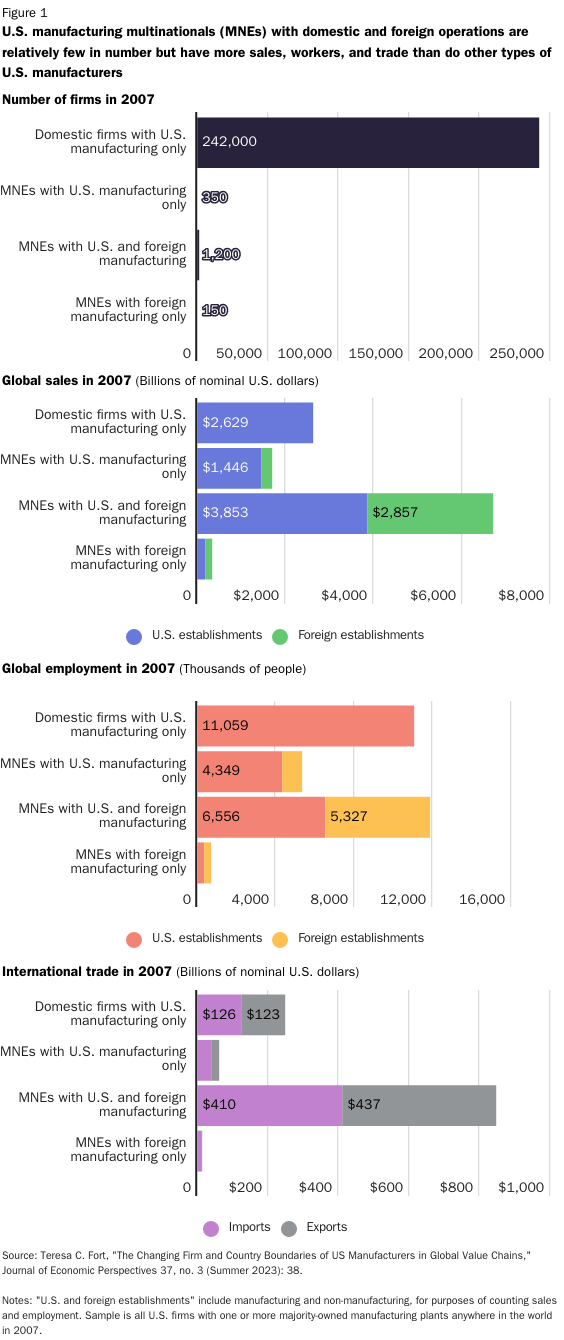

First, U.S. multinational manufacturers haven’t relocated all their manufacturing plants offshore. Fort instead finds that, of the 1,700 U.S. manufacturing firms with overseas affiliates, 1,200 owned both U.S. and foreign manufacturing plants, 350 had just domestic factories, and only 150 firms had exclusively foreign manufacturing. Thus, the most prevalent type of U.S. multinational manufacturer—by far—were “transnational” producers that own both domestic and foreign plants.

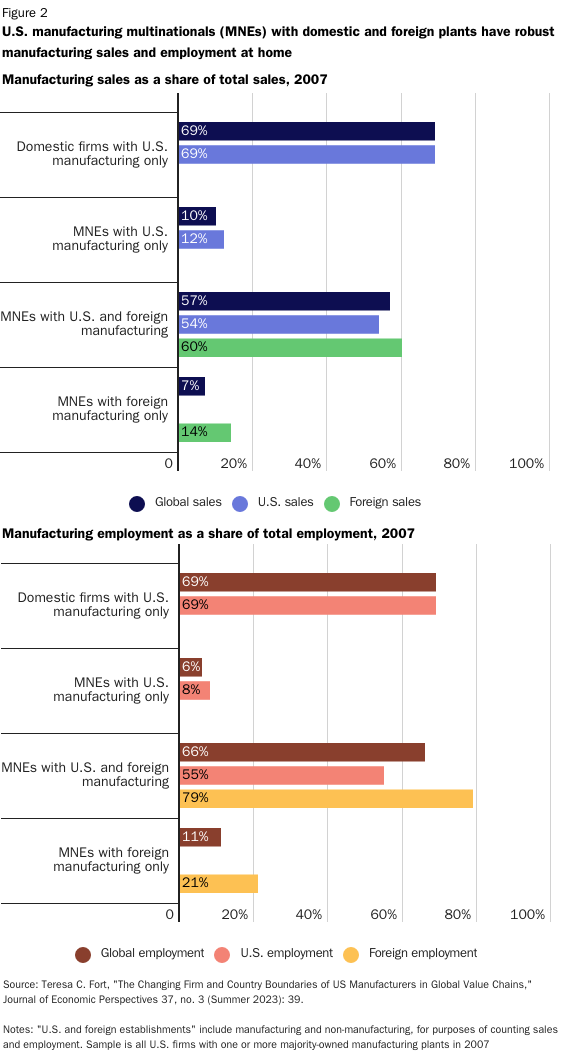

Second, these transnational manufacturers are big and important for the U.S. economy and workforce. In particular, Fort finds that U.S. firms with domestic and foreign manufacturing plants are a small share of all U.S. manufacturers (just 1,200 of 243,700 total) yet dominate the other manufacturers in terms of sales—domestic establishments’ sales ($3.85 trillion), foreign establishments’ sales ($2.86 trillion) and global sales ($6.7 trillion), which are $2 trillion more than the global sales of the other manufacturers combined. More than half of these global sales, moreover, came from the firms’ American factories.

Transnational firms also employ a lot of workers—more than half of which (6.56 million) were in the United States, and about 3.6 million of those U.S. workers worked in manufacturing plants. That’s a lot of blue-collar jobs. Overall, the 1,800 U.S. firms with some sort of overseas activity employed about 200,000 more American workers (11.27 million) than the 242,000 manufacturers that just operated domestically (11.06 million).

Fort thus concludes (emphasis mine):

In short, the notion that US firms moved almost all of their integrated manufacturing plants overseas in response to China’s accession to the World Trade Organization in 2001, and then used those plants to serve their US customers, is not supported by the 2007 data. Instead … US multinationals that manufacture in-house tend to do so in both the United States and foreign countries, and their US manufacturing plants comprise the majority of their domestic activities. These firms’ global manufacturing activities are roughly split across their US and foreign plants, with just over half of their total manufacturing plant sales originating from US establishments, and just under half of their manufacturing plant workers located in the United States.

These older data are supported by newer research showing how multinational firms’ overseas operations continue to supplement, not replace, their U.S. operations and workers. For example, a separate paper from 2021 found the vast majority of 2016 sales of U.S. multinationals’ affiliates abroad were to the host country (59 percent) or non-U.S. countries (29 percent), not back to the United States. In fact, only 12 percent of these sales fit the classic “offshoring” model that politicians complain so much about. For China, the split is even wider: Almost 83 percent of U.S. multinationals’ sales were for the Chinese market, while only 6 percent went back to the United States.

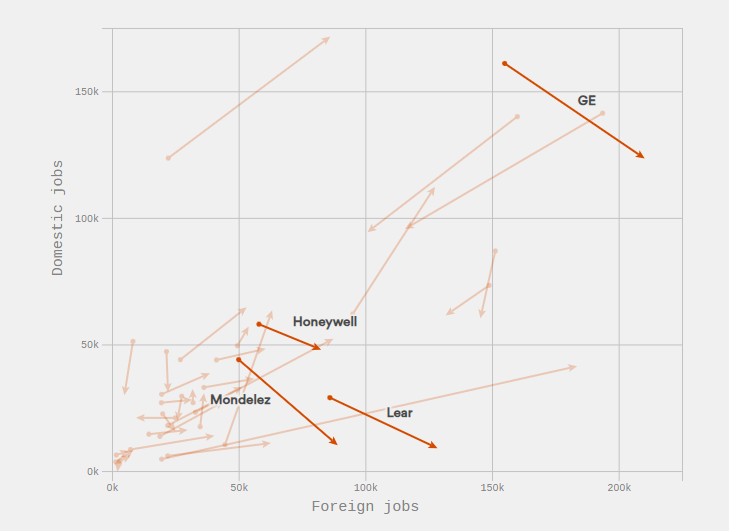

Research also finds that few multinationals increase hiring abroad and decrease their U.S. headcount (which would indicate foreign workers are replacing American ones). In 2017, for example, Axios could find only four of 250 large multinationals that did this; for everyone else, the trends ran in the same direction—domestic expansion accompanied expansion abroad, while layoffs here meant layoffs over there, too.

As I explained a few years ago, the same conclusion applies to U.S. manufacturing investment: expansion abroad typically means expansion here at home too.

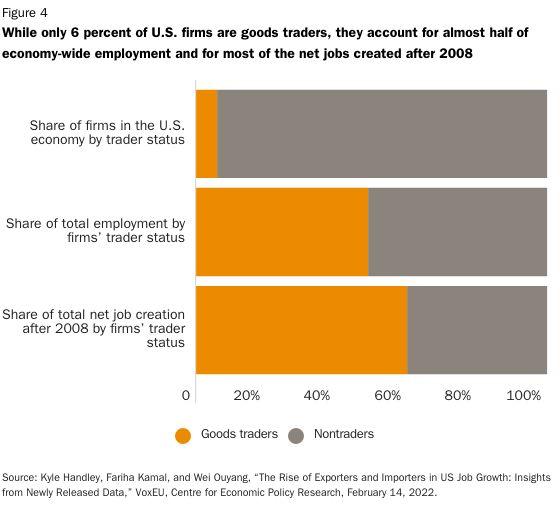

Given these trends, it’s unsurprising to see new research showing that the relatively small number of “goods trader firms” in the United States—in services and manufacturing—generated more than half of all new net jobs created here since the Great Recession:

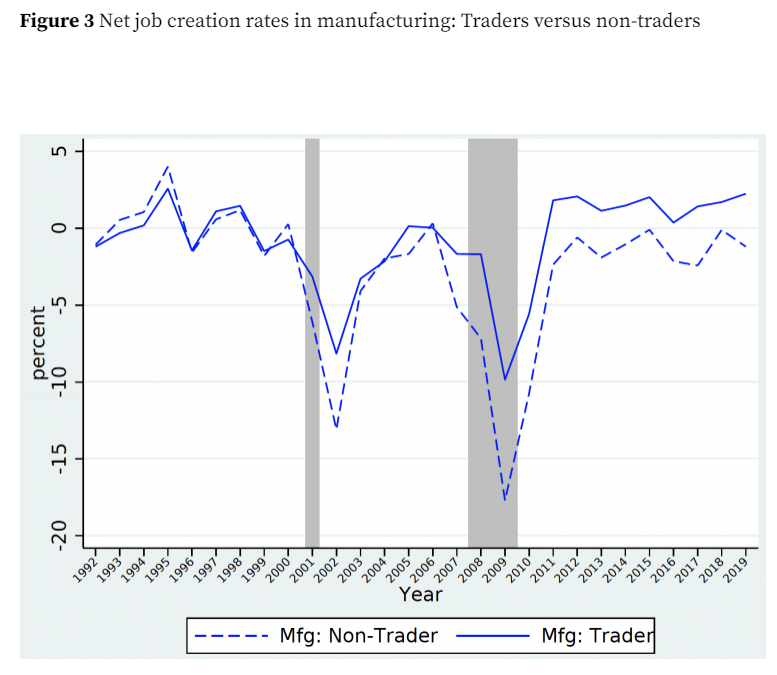

In traditional manufacturing (so, not including the factoryless companies), the employment numbers were even more stark: from 2011 to 2019, non-trading manufacturing firms’ workforce shrunk substantially, while trading manufacturers drove the sector’s job growth:

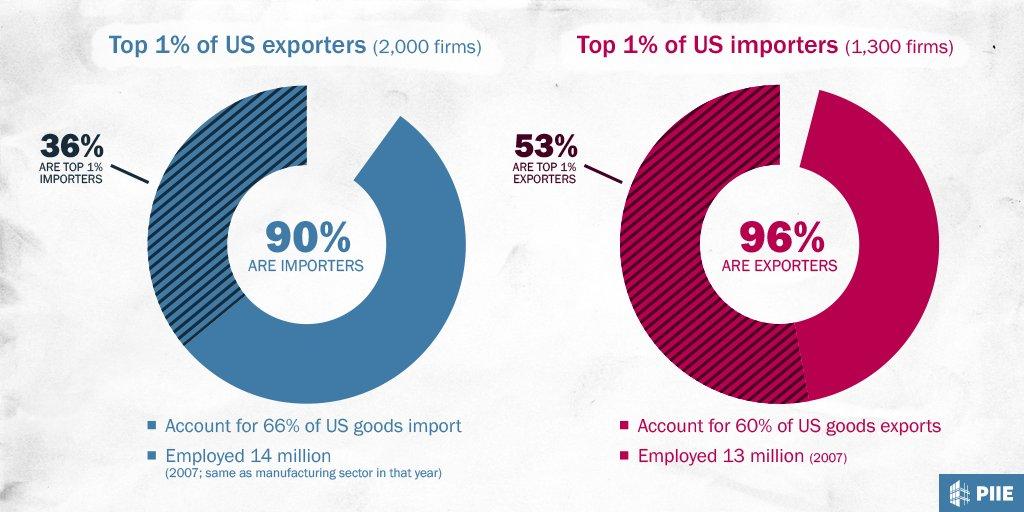

This trend gets to the third myth that Fort’s data bust: that globalization, especially imports, undermines American manufacturing output and employment. Instead, she finds that transnational manufacturers—i.e., the ones that dominate the industry—are heavily involved in international trade, importing almost as much they export (and about four times as much as all the other types of manufacturing firms combined) and doing so intensely (meaning more imports/exports as a share of total sales). These goods are often exported to and imported from affiliates abroad, but plenty go to/from unaffiliated parties as well.

Overall, these data paint multinational manufacturing in a much different and more complex light than the one we hear about so often in Washington. In particular, the biggest and most successful U.S. multinational manufacturers do import a lot of goods, but those are often manufacturing inputs (e.g., auto parts) that boost their domestic production operations (e.g., automobile manufacturing). They import finished goods too, but those often complement, rather than replace, domestic production. For example, Ford might import both parts and lower-priced Fiestas from Mexico, thus allowing its domestic plants to focus on building higher quality, more technologically advanced SUVs. These firms also export a lot—often to “offshored” partners. Combined, these trends explain why America’s largest importing firms are also some of our largest exporters. It all goes together.

(Separate research, it should be noted, shows that multinationals buy plenty of domestic stuff too: almost 90 percent of U.S. multinationals’ purchases—$8.8 trillion—were from other U.S. companies.)

Fourth, Fort’s research shows that multinational manufacturers—but especially those with overseas manufacturing operations—employ a disproportionate share of “knowledge workers” who perform both pre- and post-production tasks in the United States. In particular, she finds that, while just 3 percent of the domestic-only manufacturing workforce is in these kinds of knowledge jobs:

- About 19 percent of transnational manufacturers’ employment comes from “knowledge” jobs, the most of any category, even though goods production remains these firms’ primary domestic activity. These data suggest that transnational firms have “core competence in manufacturing particular goods” and use their U.S. knowledge workers to support their manufacturing operations in the United States and abroad.

- About 15 percent of “factoryless” manufacturer employment is in similar knowledge jobs—the second highest of the manufacturing groups. Fort further finds that these firms are relatively younger, more trade-intensive, and better-paying than comparable U.S. companies, and that they substantially increased both their number and their share of knowledge workers between 1997 and 2017. This is consistent, she notes, with previous research showing that factoryless goods producers tend to be more innovative, with higher R&D spending and more patents and trademarks than comparable firms. These and other data indicate that factoryless goods producers specialize in pre-production manufacturing stages (design and R&D) in the United States, while outsourcing the “physical transformation” stage to other firms in other countries.

Fort thus concludes (emphasis mine):

Despite their contrasting organizational forms, both transnational in-house manufacturers and factoryless goods producers hire disproportionately more knowledge workers in the United States. They also spend more on R&D and receive more patent grants. These patterns highlight the need for new trade models in which low-wage manufacturing locations enable the entry of more ideas by firms that specialize in domestic innovation. … When such specialization entails reallocation into early production stages, like design and innovation, offshoring can even lead to dynamic gains, as the returns to innovation rise, inducing growth in R&D and ideas that beget more ideas.

Put simply, offshoring helped these companies not only make a lot of money, but also—via good ol’ specialization (and some of that money)—push the technological frontier here in the United States, potentially spurring even more innovation in those U.S. companies and others.

The connection between global production and innovation is again reinforced by past research and plenty of anecdotal evidence. The aforementioned 2021 paper, for example, found that, in 2016, manufacturing sectors with higher global participation also had more R&D; thus, unsurprisingly, U.S. high-tech manufacturing was the most globalized. Fort herself notes related data on computer and electronic manufacturing, which was one of the first industries to utilize a factoryless model where U.S.-based affiliates focused on innovation while foreign suppliers handled physical production. That same industry, she notes, has accounted for “the greatest growth in breakthrough patents over the last two decades” and the majority of U.S. manufacturing output (value-added) growth between 1992 and 2011—“even as imports of computers and electronics surged.” Driving a lot of this growth is semiconductors, via both the transnational (Texas Instruments, Intel, etc.) and factoryless models (Qualcomm, Nvidia, etc.)—reflecting, as Fort puts it, the “important role for firm-level core competence and strategic focus in determining how firms organize their production across firms and countries.” It’s not one-size-fits-all.

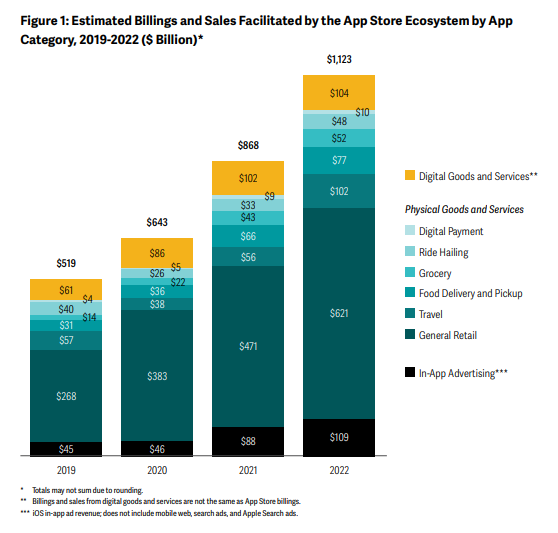

Other examples of the connection between offshoring and innovation abound. IBM famously reinvented itself from a computer manufacturer to a services firm (which still manufactures some stuff here and abroad) and is today one of the most innovative companies in the world. It’s recently announced breakthroughs on quantum computing and semiconductors, the latter of which will be produced in partnership with a Japanese producer. Apple, of course, is a fully “factoryless” company that’s also one of the world’s most innovative. It not only employs lots of Americans to research, design, market, and sell its trendy gadgets and related hardware, but also today generates more than a quarter of its revenue—$21 billion last quarter alone—from services, most of which are carried out here. Apple’s app store, meanwhile, was responsible for $1 trillion in economic activity in 2022.

Amazon is more retail-focused, but it’s also a multinational manufacturing innovator, using its made-in-India-by-Taiwan’s-Foxconn Fire TV sticks and other gadgets to boost its core streaming and retail businesses and its custom hardware—designed and built here and abroad—to fuel its massive and highly profitable cloud arm, AWS.

But as Dartmouth’s Matthew Slaughter noted a few years ago, these successful multinational models aren’t limited to tech companies: Caterpillar, for example, makes its heavy machinery both here and abroad, and does some research overseas too—but to support its main research facility in Peoria, Illinois. Dow Chemical’s massive petrochemical complex in Saudi Arabia, meanwhile, has supported tons of American jobs at Dow and at the 18 U.S. engineering, design and other high-value service companies that have won more than $1 billion in contracts since 2007. And as we’ve discussed, U.S. vaccine-makers Pfizer and Moderna are similarly productive, innovative, and global.

Overall, U.S.-based multinational manufacturers—transnational and factoryless, tech and non-tech—routinely top the rankings of the world’s most innovative companies:

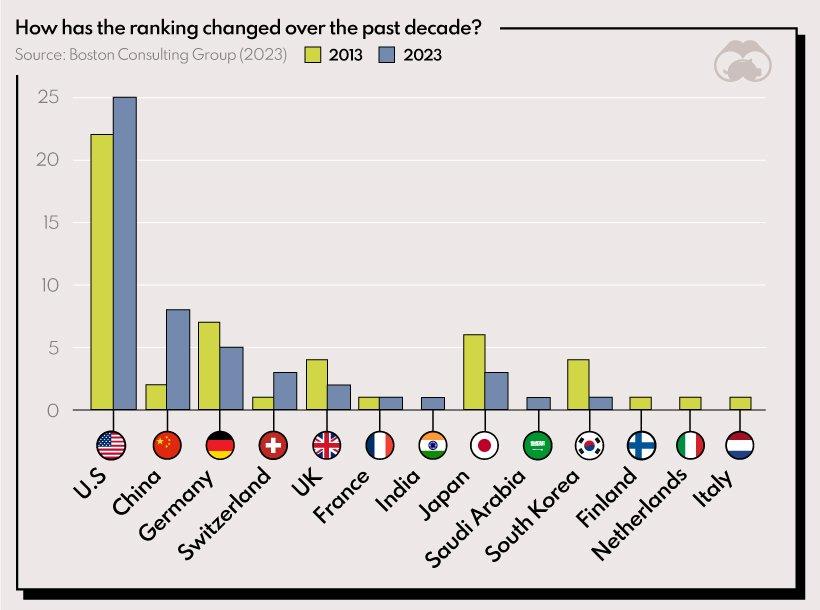

In fact, the United States has not just maintained its global dominance over the last decade, it’s added more innovation leaders to the list:

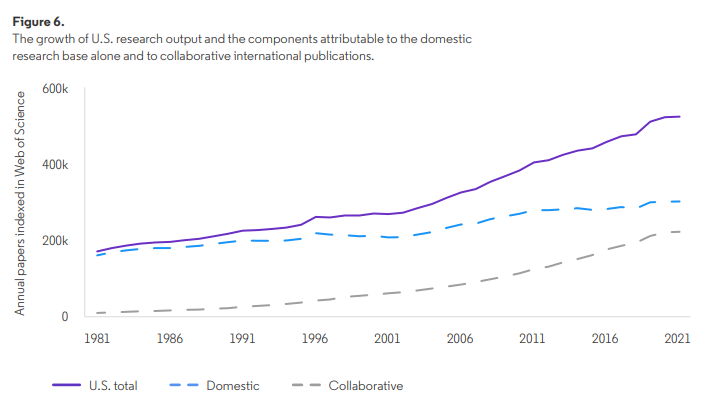

Yes, China has advanced too, but there’s nothing in here to indicate that decades of offshoring or “unfettered globalization” have caused America to lose its tech edge. If anything, the opposite is true: New research shows that the United States’ continued research dominance stems in large part from our disproportionate use of global collaboration, especially in physical sciences and technology:

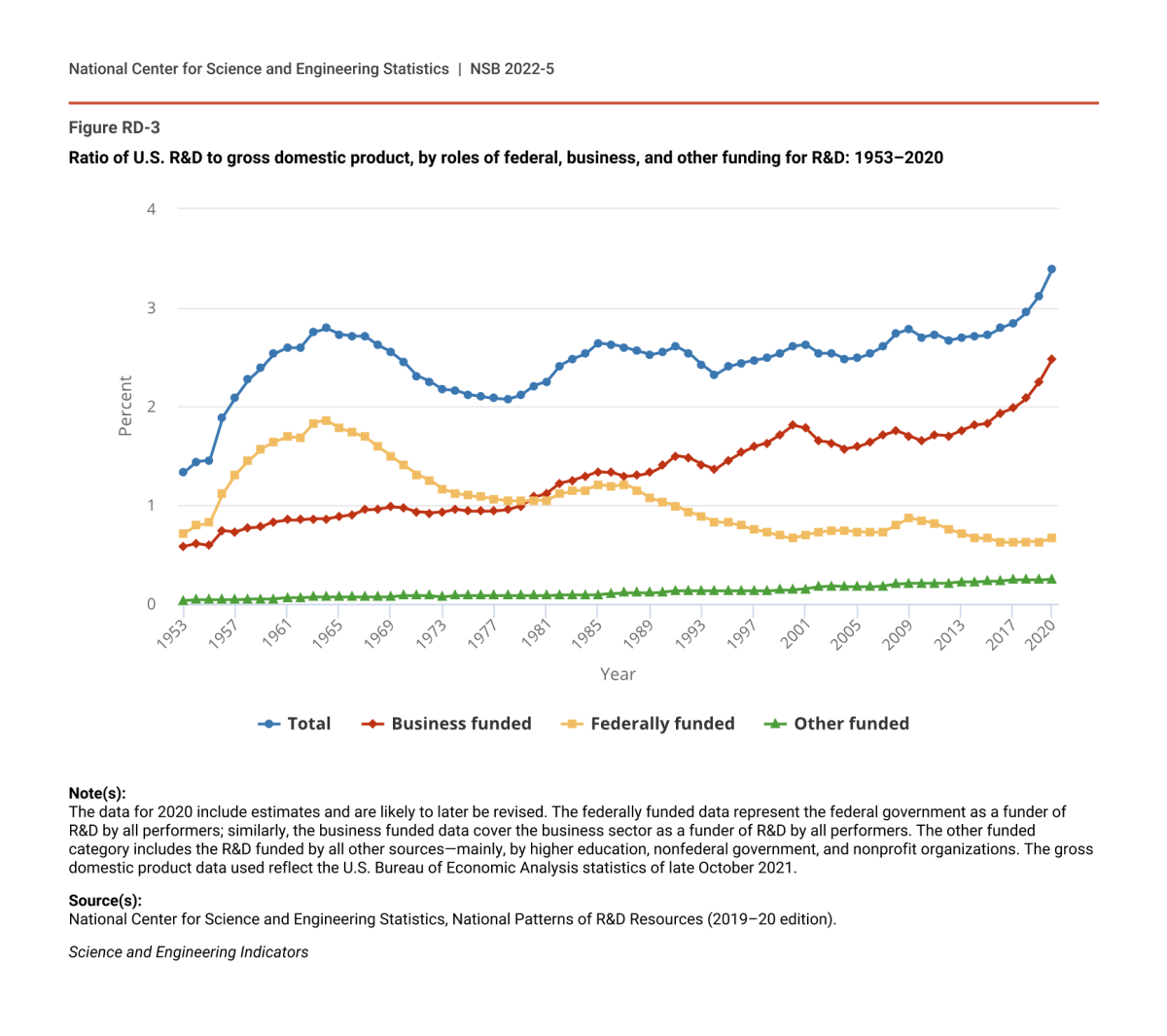

And while government R&D funding had—until recently—remained relatively flat in recent years, corporate spending has fueled new (inflation-adjusted) records:

Finally, Fort adds a deserved note of caution about current efforts to re-shore multinationals’ foreign manufacturing operations: Any such shift could end up hurting the companies’ innovation-focused U.S. activities (emphasis mine):

If integration and location decisions are interdependent, then changes in trade policy will not only affect the location of production, but also influence the scope of firms’ integrated activities. …. These links are essential to analyze the costs and benefits of potential changes in trade costs, such as the recent proposal by the US National Security Advisor, Jake Sullivan (2023), to protect US technology “with a small yard and high fence.” Such proposals may upset the current balance between domestic innovation and foreign physical transformation. Factoryless goods producers may be particularly susceptible, as they cannot relocate their suppliers’ unilaterally.

In short, government efforts—via tariffs, localization (“Buy America”) mandates, and subsidies—to onshore innovative multinationals’ manufacturing operations could result in them devoting fewer domestic resources to their world-beating innovation operations. As Taiwanese chipmaker TSMC has warned, for example, even with massive government subsidies its U.S.-made chips will be more expensive than their Taiwanese counterparts. If those higher costs are passed on to “fabless” customers like Apple or Nvidia (today considered “likely”), will those companies spend less on their amazing R&D? As Fort notes, current trade models “simply do not capture today’s reality in which US firms sell final goods manufactured abroad but designed, distributed, and marketed using domestic labor and ideas.” Our politics surely don’t either.

Summing It All Up

To recap, offshoring doesn’t necessarily mean less U.S. manufacturing or fewer jobs—but it does likely mean more knowledge work and innovation here at home. “Contrary to the fear that participation in global value chains entails a loss of technological skills,” Fort concludes, multinational manufacturers in reality employ a disproportionate number of knowledge workers and are disproportionate contributors to innovation activities (R&D, patenting, trademarks, etc.). The result of these globalized business models has been world-beating companies and lots of American jobs. Efforts to reverse this globalization—especially when paired with other policies (e.g., immigration restrictions) that discourage domestic innovation—might not kill our Golden Goose, but they sure as heck won’t be helping it fly.

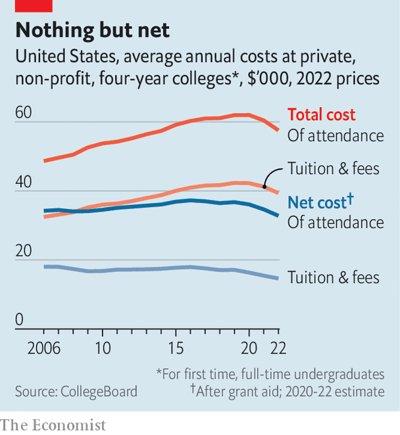

Chart(s) of the Week

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.

With your membership, you only have the ability to comment on The Morning Dispatch articles. Consider upgrading to join the conversation everywhere.