Dear Capitolisters,

Over the weekend, President Biden personally attacked me. OK, fine, it probably wasn’t personal, but it’s still hard not to get a little angsty when, after writing thousands of words on supply chains over the last few months, you hear the president of the United States tell a press gaggle, “you all write for a living. I haven't seen any of you explain the supply chain very well.”

Well, harumph to you too, Mr. President.

Anyway, I’m mostly kidding about the angst (mostly). However, Biden’s comments do provide us with a good opportunity to check back in on the supply chain situation and to ask whether the president himself really understands what’s driving some of these problems and whether he’s really up to tackling them.

Recent history suggests that he’s not.

Supply Chain Update

As you’ll recall, back in September I explained that, while pandemic-related supply and demand factors were the superficial cause of the current supply chain mess, various trade, labor, and other policies were exacerbating the situation by limiting system-wide efficiency and flexibility. Since then, we’ve discovered that other policies are also playing a role. At the federal level, for example, the “worker shortage” that experts in the field have routinely cited as hurting U.S. trucking, warehouse, and related industries has been amplified by two federal policies:

First, continued restrictions on immigration have removed at least 1 million potential (and lawful) workers from the U.S. labor market, putting acute pressure on labor-intensive industries like warehousing. (And backed-up warehouses make it more difficult to clear containers that are stacked up at various ports.)

Second, the United States has effectively barred Mexican trucking companies from operating on U.S. roads, thus keeping “the largest and closest supply of potential US truck drivers” out of the country and reducing the number of American trucks available for inland work because they’re picking up cargo at the border from Mexican truckers who have to drop it there. (In case you’re wondering, multiple U.S. government pilot programs have found the few Mexican trucks that were allowed to operate here to be safe and clean, in part because they all have to comply with U.S. regulations.) These restrictions have long violated our commitments under the North American Free Trade Agreement, yet President Trump actually tightened them in his NAFTA update, the USMCA.

Adding insult to injury, we learn from the same report that Canada has national and provincial initiatives to help foreigners immigrate and work in its trucking industry, alleviating some of the pressure there. (They’re always sticking it to us on immigration!)

State and local policies are also taking a toll—especially in California, which is home to the biggest and most important port complex in the country (Los Angeles/Long Beach). Most notably, we learned last month that a key reason why containers were clogging up the LA/LB port (preventing ships from quickly unloading and thus adding to the historic offshore queue) was, as Virginia Postrel noted for Bloomberg, land use restrictions:

It turned out that the main problem wasn’t an absolute space constraint but a local zoning regulation. Long Beach prohibits companies from stacking off-loaded containers more than two high. The law is not a safety regulation but an aesthetic one. City officials decided that stacks of containers more than eight feet high were too ugly to tolerate.

Local officials have since waived these rules, but only after they drew national attention—weeks, if not months, after the problems started. Even then, moreover, other problematic zoning regulations remain in place, and state law prevents localities from quickly changing them. Thus, one L.A. official recently urged Gov. Gavin Newsom to waive that state rule so that L.A. and other localities might act:

The city has identified several port-owned plots that could be quickly paved and transformed into storage sites if not for existing red tape, he said. "The lots are quite small. But if you could pull together 10 or 12 lots, and put 40 containers on each of them, that's 500 containers… That's some serious relief."

That state rule seems dumb, but it’s really the original zoning ordinances—which prevent ports from quickly paving their own property!—that are the real problem here.

Finally, various California land-use and environmental regulations have made building new warehouses exceedingly difficult—a serious problem now that free warehouse space is essentially non-existent. As Bloomberg notes, for example, “warehouse space is at an all-time low [but] building new warehouses takes a minimum of two years and as many as nine in parts of California, where the industry says regulations are more strict.” A new Wall Street Journal editorial provides frustrating details in this regard, noting that an e-commerce-inspired warehouse construction boom in California caused backlash from environmentalists and “not in my backyard” locals who complained of truck pollution (never mind California’s extra-tight restrictions on truck emissions!) and noise. As a result, new local ordinances and other regulations have blocked the construction of several new warehouse and truck facilities—space that we sure could’ve used right now.

Meanwhile, the Port of Houston—which is admittedly smaller than LA/LB but is also subject to far more permissive construction regulation—has been building warehouse space like crazy (and is having fewer port backlogs) and thus enticing some retailers to shift to that port during the current crisis. Texas Gov. Greg Abbott even went to Twitter to encourage those moves, but, with so much of the supply chain historically centered on the Golden State (and with the simple time/money cost of using the Panama Canal), there’s only so much that can be done here.

These policies—along with the ones I noted in September (and surely a few others)—have helped to create a domestic port, logistics, and infrastructure system that just can’t handle the unexpected stress of the pandemic (and related government stimulus). As Flexport’s Ryan Peterson, who first noted the California zoning problems, recently put it:

Consumers are just buying more stuff than ever. … And our infrastructure, frankly, isn't ready for it. And so we've definitely exposed that our infrastructure is going to be a governor on growth. It's going to prevent us from achieving the kind of recovery and opportunity that the consumers and the economy wants to do right now.

And it's getting held back by dilapidated port infrastructure, by congestion, traffic of non-automated ports and sort of bad rail connections to the port. We're just recognizing the pain of 20 years of not investing in our infrastructure. And we're feeling all that pain in one year right now.

Or, to quote another wise sage (whom the president clearly doesn’t read), America’s ports problem is decades in the making.

But It’s Not Just the Ports

The port situation is indicative of a broader sclerosis that infects significant parts of the U.S. economy—one caused in no small part by the types of policies discussed above. Although those policies cover a wide range of issues, the thread that runs through them is the prioritization of narrow interest group objectives (profits, jobs, home prices, bureaucratic systems, etc.) over broader productivity, capacity, and flexibility improvements. As Postrel explained with respect to California zoning:

The situation exemplifies why the formerly can-do state of California has become such a difficult place to build anything, including an upwardly mobile life. In the name of protecting local vistas, a seemingly minor rule got enacted that exacted enormous aggregate costs far beyond the immediate area. The voters in Long Beach gained a modest improvement in the view while the entire national— indeed global— economy suffered from less efficient shipping. (The Port of Los Angeles is two nautical miles from the Port of Long Beach, and the two account for about 40% of U.S. container traffic.)

It’s a classic example of a well-recognized issue in political economy. The benefits of the policy are concentrated while the costs are dispersed, spread out among tens of thousands of businesses and millions of consumers. Under ordinary circumstances, most of those hurt have no idea what’s happening. Only in a crisis does anyone beyond a few industry insiders recognize the harm.

One can say the same things about politically powerful port unions’ anti-automation efforts, tariffs on Chinese chassis (and the laws that allow them), much of the environmental regulation (which is often just an excuse for NIMBYism), the Mexican trucking ban (which the Teamsters have long championed), and—of course!—the Jones Act. In almost every case, the insular interests of a politically powerful minority were able to dictate policy to the detriment of the state or nation as a whole—a cost that’s minor and diffuse in the good times, but can become major and acute in the bad ones, especially when these policies all combine, Voltron-style, to smash delicate supply chains already reeling from a generational, global shock.

And these policies’ effects surely extend beyond just the ports and warehouses, with similar consequences. In a viral essay published early last year, for example, venture capitalist Marc Andreessen issued a call-to-arms that “it’s time to build” again, following decades of not doing so in America. He blamed our inaction on “inertia” and “regulatory capture,” but didn’t really elaborate. The best job doing so (that I saw, at least) came from Coin Center’s Jerry Brito, who—echoing Postrel above—explained what makes building stuff so darn tough in America these days:

Our collective will, expressed through our democratic institutions, has decidedly been to slow or prevent innovation and building in all the areas Andreessen singles out: housing, education, transportation, medicine, finance, energy. Those are all regulated sectors of the economy, and as Andreessen hints, the regulatory apparatus has been captured by incumbents who will use it to keep out innovation that threatens their position.

But here’s the important point: those small interest groups, acting through democratic institutions, to prop up their interests at the expense of the greater public’s is not some subversion of the system; it is the democratic expression of society’s will. Entrenched incumbents are not just people who look like the Monopoly Man, incumbents are also public school teachers, coal miners, doctors and hospital administrators, flight attendants, and truckers.

Mancur Olson, one of the greatest thinkers of our time, explained our predicament decades ago in two important books: The Logic of Collective Action and The Rise and Decline of Nations. He showed that, on a given question, small groups (like energy incumbents) are easier to organize than large groups (all Americans who would benefit from nuclear energy) because their direct incentives are greater. Benefits are concentrated and costs are diffused, so acting openly and legitimately through democratic channels interests groups will secure protection even at the expense of the greater public. The result is that “society, acting collectively through its democratic institutions” sends a clear message: “We don’t want these things.”

A stable democracy with the rule of law is a perfect environment for groups to form, grow, and attach themselves to the body politic. Over time interest groups and rules accrete, and after a certain point nations burdened by so much accumulated regulation will become sclerotic and fall into economic decline. And that’s where we are today. That’s why we’re not building.

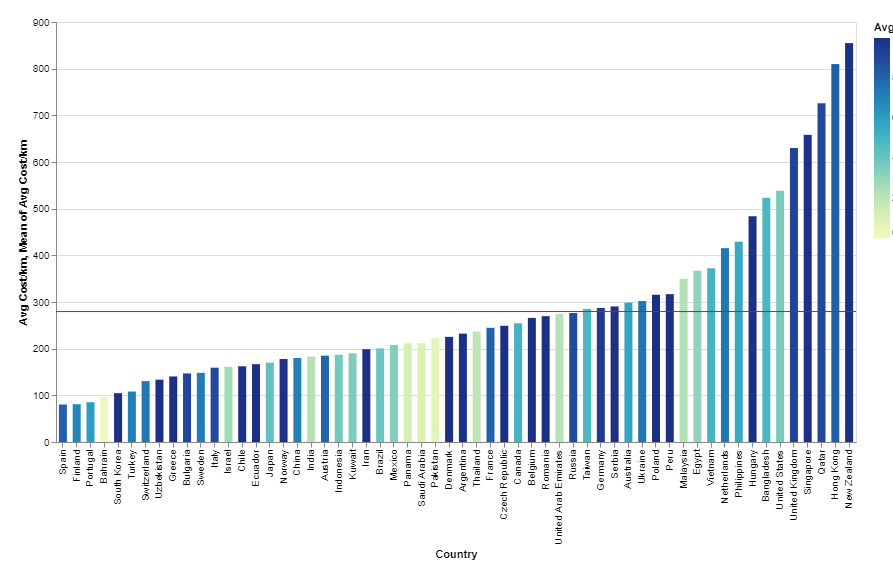

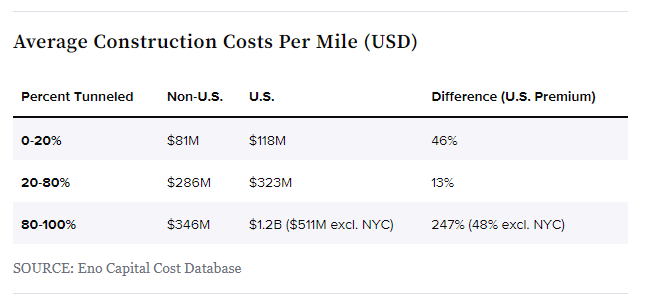

Our national sclerosis is perhaps most obvious in (though certainly not limited to) the basic costs of construction here. As Bloomberg’s Justin Fox noted last year, for example, the real cost of building a mile of interstate highway has quadrupled since the late 1950s and early 1960s, and multibillion-dollar transit projects in New York City are today as much as 10 times the cost of similar projects in continental Europe and Japan. Other studies show similar things:

America’s cost issues extend to real estate too. According to a 2021 global survey of major cities’ commercial and residential construction costs from consultants Turner & Townsend, for example, the United States is home to seven of the top 15 most expensive cities in the world for building midrise office space, shopping centers, warehouse distribution centers, and townhouses: San Francisco (3); New York City (4); Boston (7); L.A. (8); Chicago (10); Seattle (12); and Tampa (14). American cities that we think of as relatively cheap—Austin, Nashville, and Atlanta—are well above-average and more expensive than “costly” places like Paris, Toronto, Milan, Vancouver, and Singapore. Only lightly zoned (and immigrant-heavy) Houston is in the middle of the pack, yet building there still costs more than in many modern, developed country cities like Sydney, Australia, even with (per the study) significantly lower construction labor costs. (Chicago and Sydney have about the same labor rates.)

High U.S. construction costs imperil efforts to improve capacity and productivity—in the public and private sector—and experts provide a wide range of reasons for the current problems. However, they tend to come back to the same general thing: a regulatory system that privileges and empowers incumbents and cronies over actually building stuff.

Does Biden Get Any of This?

Does Biden recognize these fierce political dynamics—for the supply chain situation or any other—and is he willing to confront them? I can’t speak to the former question (lest I get yelled at like those poor pool reporters), but the answer to the latter doesn’t look very promising. For example, the White House was out this week promising that the bipartisan infrastructure bill would (eventually) fund various supply chain improvements, but, as I noted in a recent blog post, that same bill contains Buy America and Davis-Bacon rules that financially benefit certain groups—steelmakers, construction unions, etc.—but have been repeatedly shown to raise costs, lower the quality of work, and delay U.S. construction projects for months or even years. (For more on how Buy America confounds infrastructure projects, go here.) As we’ve discussed, moreover, the Jones Act—which Biden loves—severely limits the ships and workers available to dredge (and thus expand) U.S. ports, thus resulting in “high costs and unnecessarily lengthy timelines for the completion of urgently needed projects.”

The infrastructure bill also pays mere lip service to reforming the National Environmental Policy Act (NEPA), which significantly empowers our national “vetocracy” and increases both the cost and time needed to complete infrastructure projects. Indeed, Biden’s EPA earlier this year issued an “Environmental Justice Primer for Ports,” trumpeting how U.S. port improvements would need to clear NEPA and other regulatory hurdles that require “meaningful engagement” from surrounding communities.

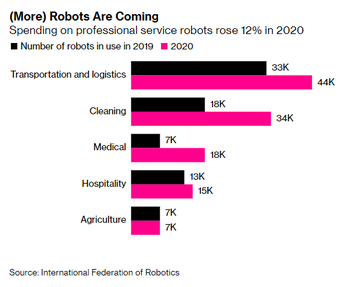

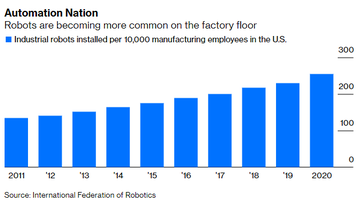

The latest version of Biden’s Build Back Better plan raises additional red flags. For example, billions in additional federal spending on U.S. ports (to reduce air pollution) appear to expressly exclude investment in automation—the lack thereof being one the key reasons that U.S. ports are currently so inefficient! It also provides convoluted bonus subsidies for electric vehicles made by unionized U.S. factories, even though such subsidies are blatant protectionism and several non-union U.S. factories actually pay more than their unionized counterparts.

Outside the legislative space, things aren’t much better—even in areas directly related to the supply chain. See, for example, a new report from National Review’s Dominc Pino on White House efforts to permanently mandate two-person crews in freight rail locomotives, even as new technology makes that standard obsolete and as European rail systems use one-person crews. But the mandate would fulfill a Biden campaign promise and has been pushed by a U.S. rail workers’ union trying to prevent the implementation of new productivity-enhancing (read: job-killing) technology. As Pino notes, this might be a political win for Biden, but it also has costs: “Freezing the current level of labor productivity on freight trains is exactly the kind of policy decision that makes the American transportation industry unable to adapt to changing circumstances.”

And then there is the deal Biden just negotiated with the EU on Trump’s tariffs on steel and aluminum, which are contributing to sky-high prices here and thus harming U.S. manufacturing, construction, and other companies. Instead of simply removing the tariffs, Biden negotiated a complex system of “tariff rate quotas,” under which limited volumes of European imports may enter the United States duty-free (with anything over those amounts getting hit with tariffs). As my colleague Inu Manak and I explained last week, the system is restrictive and complicated: duty-free volumes set at only about 65 percent of their pre-tariff levels, and quotas are divided into 54 separate quotas on steel and 16 on aluminum, allocated among all EU member states on a quarterly basis. That results in, as Georgetown’s Jennifer Hillman helpfully calculated, 5,832 separate limits on steel and 1,728 on aluminum; thus, “it will be very hard for EU exporters to use even 75% of the quotas given how small the allocations are per product and per country once you divide them up.” The convoluted system will also, per the Wall Street Journal, inevitably discriminate against small businesses that lack the resources to track shipments, monitor quotas, handle complex documentation rules, and carefully time their goods’ arrival. As one manufacturer told the Journal, “[g]iant companies are going to have the clout and financial capability where they can go in and place large orders and suck up the quota.” And the little guys will be left paying the tariffs.

No wonder, then, that politically powerful steelmakers and steelworkers unions have cheered the EU deal, even though, as the Journal notes, “[f]ar more companies consume metals than produce them. When the tariffs began, federal data showed there were around 29,000 steel-consuming firms, compared with only about 900 classified as steel producing and 600 for aluminum”—a number that doesn’t even include the large U.S.-based automakers.

Collective action strikes again.

Summing It All Up

Policies that prioritize and protect narrow political interests over broader, national ones surely didn’t cause the supply chain crisis, but they just as surely exacerbated the situation. Reforming those policies (and others like them) isn’t easy, given the wide range of issues and strong political forces that would surely rise in opposition. But doing so would go a long way toward not only having a supply chain less vulnerable to future shocks but also breaking through the broader American sclerosis. Biden’s team, to their credit, hasn’t been entirely bad when it comes to addressing some of these policies—seeking, for example, to modestly encourage better local zoning policy or to free up U.S. visa backlogs (though neither initiative has made it very far). But the president has thus far shown little interest in confronting any of the policies backed by powerful interest groups and legislators in his own party, and in many cases is actually championing them.

Maybe some journalist can explain that to him.

Chart(s) of the Week

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.

With your membership, you only have the ability to comment on The Morning Dispatch articles. Consider upgrading to join the conversation everywhere.