A meme seen widely on platforms including X (formerly Twitter), Instagram, Facebook, and Reddit suggests that the United States does not tax its billionaires, while most European nations levy substantial taxes on the ultra-wealthy.

The meme—based on a scene from the 2013 comedy We’re the Millers—claims that while Sweden, the Netherlands, and Germany tax their billionaires at 55.5, 49.5, and 47.475 percent respectively, U.S. billionaires aren’t subject to that level of taxation, playing into a common trope that billionaires in America pay little to no taxes. This idea was even reinforced recently by President Joe Biden during the 2024 State of the Union address, in which he misleadingly claimed that billionaires pay an average tax rate of only 8.2 percent.

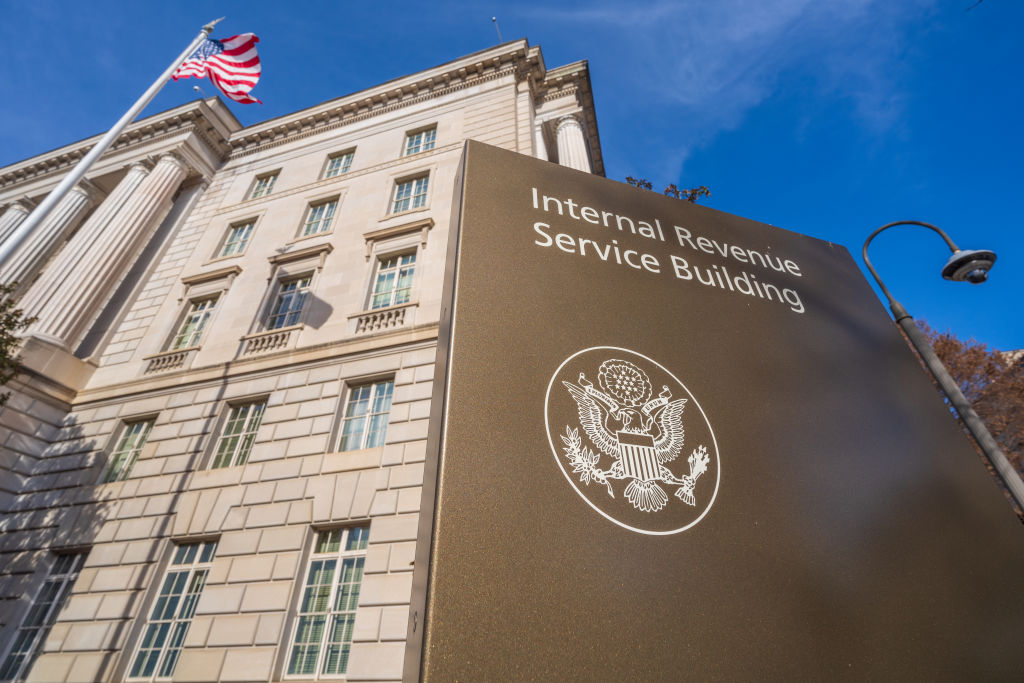

Billionaires are subject to the same income and capital gains taxes as all Americans, and their payments to the IRS make up a significant portion of the country’s tax proceeds.

How much do American billionaires typically pay in taxes?

Although American billionaires have high net worths based on the value of their assets, many of the county’s wealthiest individuals do not necessarily have high wage incomes—meaning the salary they are paid as part of a job. For example, Jeff Bezos—the founder and executive chairman of Amazon—has taken a yearly base salary of only $81,840 since 1998 despite having an estimated net worth of almost $200 billion. The vast majority of Bezos’ wealth instead derives from his approximately 10 percent ownership of Amazon, which has a total market capitalization of $1.83 trillion. Mark Zuckerberg takes an even lower salary—only $1 per year—as the chief executive officer of Meta. Like Bezos, Zuckerberg’s $177 billion net worth comes primarily from his 13.5 percent ownership stake in the company he helped create.

In most countries, incomes are taxed differently than wealth gained through the appreciation of assets—such as stock owned in a company. Taxes are typically not levied on capital gains until the asset is actually sold. In the U.S., capital gains, once realized, are taxed at a rate of 20 percent for most high earners. So, even if a billionaire sees their net worth grow by hundreds of millions of dollars in a single year, if that growth is in the value of unrealized assets, it will not be taxed as a capital gain until those assets are sold.

Billionaires are fully subject to both federal and state income taxes when applicable. In 2023, the top marginal income tax rate in the U.S. was 37 percent for individuals with an income above $578,125, and state income taxes can add anywhere from an additional 2.5 percent to 13.3 percent, depending on where an individual files. Most states also levy their own tax on capital gains, either as a part of a person’s broader income or at a separate capital gains rate.

The wealthiest Americans, therefore, do pay significant amounts in taxes—a fact that is backed up by government data. According to the U.S. Department of the Treasury, in 2024 the top 1 percent of income earners will pay an average federal tax bill of 31.5 percent on their adjusted cash income, while the bottom 50 percent of American earners will pay anywhere from minus 4.8 percent to 10.1 percent when refundable tax credits are factored in. In 2021, the top 1 percent of American earners paid 46 percent of the nation’s total income tax revenue despite earning 26.3 percent of total adjusted gross income.

What about Europe?

Even though billionaires and the ultra-wealthy in the U.S. do pay significant federal and state taxes, it is also true that the wealthiest residents in most European countries—including Sweden, the Netherlands, and Germany—are subject to a higher tax burden than those in the U.S. At the same time most European countries also tax their lower and middle classes at much higher rates than in the U.S.

In Sweden, the top municipal income tax for individuals, which ranges from 28.98 to 35.15 percent, kicks in at a yearly income of only around $59,000. Above this amount, an additional 20 percent national income tax also takes effect, bringing the total tax burden for incomes above $59,000 to an average of 52.34 percent. Capital gains also are taxed at a higher rate, with most paying 30 percent.

In 2022, annual income between approximately $63,000 and $300,000 in Germany was taxed at a rate of 42 percent, rising to 45 percent for any amount above $300,000. In addition, income tax surcharges can be levied for various other purposes, including a 5.5 percent solidarity surcharge for high earners and an 8 or 9 percent church tax on members of officially recognized religious groups. Capital gains are taxed at 25 percent in Germany.

The top tax rate is even higher in the Netherlands, where a 49.5 percent levy applies to income above approximately $82,000, and income below this threshold is taxed at 36.97 percent. Unlike many other Western countries, the Netherlands does not have a flat capital gains tax, and instead levies a 31 percent tax on the 5.69 percent hypothetical yield of a person’s wealth.

High earners in the U.S. are subject to a lower overall tax burden than their peers in European nations, but there are many more of them contributing to America’s tax coffers. As of 2023, there were around 751 billionaires residing in the U.S., 26 in Sweden, 109 in Germany, and 10 in the Netherlands.

If you have a claim you would like to see us fact check, please send us an email at factcheck@thedispatch.com. If you would like to suggest a correction to this piece or any other Dispatch article, please email corrections@thedispatch.com.

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.

With your membership, you only have the ability to comment on The Morning Dispatch articles. Consider upgrading to join the conversation everywhere.