U.S. consumers have been pessimistic about the housing market all year and show no signs of changing their opinions.

According to a national housing sentiment survey commissioned by Fannie Mae, only 14 percent of consumers say now is a good time to buy a home—a new low for the survey. But consumer sentiment is just one feature of a landscape where rising inflation and fluctuating interest rates intersect with global events and supply chain upheavals.

How has the housing market changed since COVID-19?

Before the COVID-19 pandemic, the U.S. housing market was strong. Historically low mortgage rates and rising house prices had persisted for years, coinciding with a long period of under-building. The upshot was a market with lots of sales activity and limited supply.But COVID-19 changed that. After initial lockdown disruptions in early 2020, the market quickly rebounded with intensified demand.

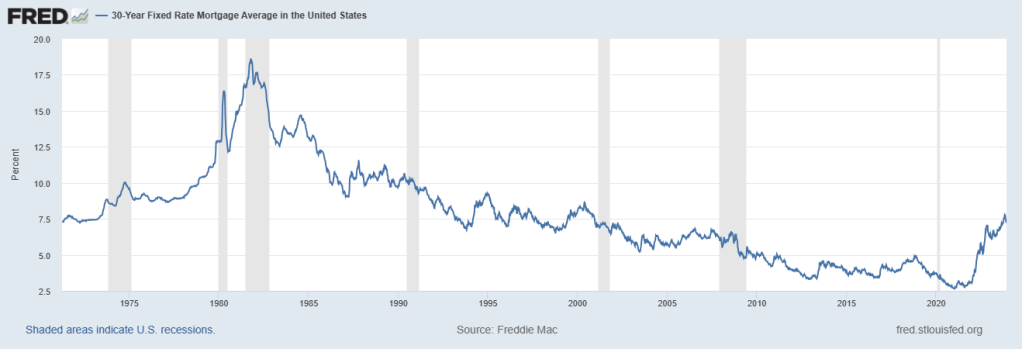

This was especially true in suburban areas, spawning a phenomenon termed the “donut effect” (when prices go down in city centers but go up in surrounding suburbs). Fueling it were remote work arrangements and consumer preferences for more space, along with indicators of an 18 percent jump in people seeking to relocate to different metro areas. This surge in demand, coupled with historically low mortgage rates, created a highly competitive market, particularly for luxury homes and second properties.Then inflation roared into the picture like a pot boiling over: High consumer demand, expansive government stimulus injecting massive capital into the marketplace, tangled supply chains, labor shortages, soaring energy costs—all stirring up the highest inflation in over four decades. This led the Federal Reserve to cool things off by raising interest rates, causing mortgage rates to surge. The stream of homeowners trading up for something better slowed to a trickle given the pain of swapping a 3.5 percent mortgage rate for 7 percent (known as mortgage rate lock-in)—a pain that was absent in January 2022 and the norm by November. Prospective buyers, looking at that same 7 percent pain, decided to keep renting instead.

What’s the current status of the housing market?

As rate increases have tapered off, the housing market presents a curious mix of standoff and musical chairs. Higher mortgage rates have slowed home sales to a crawl, on track this year to hit their lowest point since 2008. Initially, home prices dipped too, but with supply being so low in 2023 they began to climb again.

This backdrop paints the current, somewhat paradoxical landscape of the U.S. housing market:

- Low Market Activity: It’s a peculiar standoff—sales are down as buyers and sellers seem to be waiting for each other to make the first move. The result? A market caught in a loop of hesitation, amplified by high prices and mortgage rates/lock-in. (Even those luxury homes everyone was previously clamoring for are gilded cages now).

- High Home Prices: Contrasting with the sales slowdown, home prices are on an upward trek, spurred by the ever-present shortage of housing supply. (There are efforts to address the supply problem, and much discussion of the problem of NIMBYism and other related factors that cause the shortage to persist. Much of this is difficult to solve, however, when the path to correcting it is different for each state or city, with often broad misunderstanding of and opposition to what would help).

- Mixed Rental Market: The rental arena is a mixed bag. Nationally, rent prices seem to be dropping this year, but they might be on the rise more recently and certain cities have seen substantial increases, reflecting a patchwork of local economic dynamics.

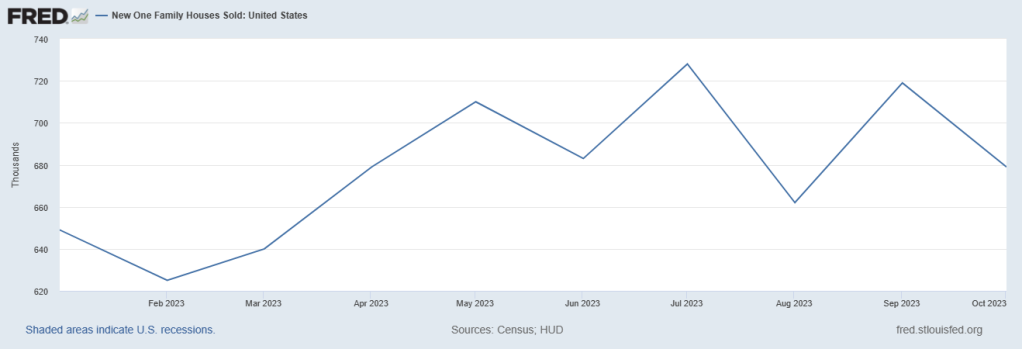

The market seems to be in a holding pattern, with participants eagerly monitoring the possibility of major shifts in broader market indicators (e.g. major zoning law changes that allow more building, notable inflation/rate shifts). In the meantime, with existing sales down, month-to-month changes in new home sales get lots of attention as they now make up over 15 percent of the market. Deriving meaning from a single-month metric can be akin to reading tea leaves though—particularly when the metric has been so volatile in recent months.

What should we make of this heading into 2024?

Facing a deluge of housing forecasts, one wonders which, if any, one should heed. The answer is virtually none.

Housing market forecasts can resemble predictions for next month’s weather—educated guesses with a shaky track record. The market is an equation made from summing “fundamentals” (e.g. interest rates, supply-demand seesaws) and the unpredictable tides of human behavior.

During the 2007-08 Great Recession, for example, people’s beliefs had more sway over house prices than actual market fundamentals. Economists Tyler Cowen and Alex Tabarrok of George Mason University suggest that what we thought was a housing bubble bursting was more of a “negative bubble,” driven by sheer panic over shadow banking. Put differently, a panic caused a reverse bubble that artificially deflated prices for a time.

Other research echoes this boom-bust-rebound saga, though noting a return to market basics over the long haul. In other words, over a shorter term the market’s dance is often driven primarily by public whims. In the longer term, it’s the traditional forces of supply, demand, inflation, and interest rates that call the shots. (For an engaging seven-minute explanation of housing economics, check out this video at Marginal Revolution University).

Forecasting, then, is a complex juggling act. It’s about more than just grasping global dynamics like wars, pandemics, supply chain challenges, and inflation swings. Forecasters also need to predict how people and companies will respond to emerging trends like remote work or the AI revolution. And, of course, there’s always a local real estate soap opera layered on top as well. The “Amazon Effect” in Arlington, Virginia, is a prime example: A single corporate move can flip a market on its head, then flip it back.

Thus, accurate forecasts must correctly anticipate world events, macro market fundamentals, crowd behavior, and local market specifics. Given this, it’s no surprise that even the experts are often wrong. In today’s housing market, a blend of low activity, high prices, and mixed rental trends creates a perplexing scenario. Buyers are navigating a tightrope between seizing deals with steep costs and waiting for a market cooldown that may never come. Sellers, while benefiting from scarce inventory, grapple with the constraints of rate lock-in. This intricate landscape fuels a continuous effort among both buyers and sellers to pinpoint the “right” time for market moves, a pursuit reminiscent of trying to time the stock market, where even robust, evidence-based strategies are often ignored in favor of efforts to control the uncontrollable.

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.

With your membership, you only have the ability to comment on The Morning Dispatch articles. Consider upgrading to join the conversation everywhere.