Dear Capitolisters,

Two weeks ago, the Department of Justice and Federal Trade Commission proposed new draft guidelines on how the U.S. government would police corporate mergers and block illegal ones (i.e., ones that substantially “lessen competition” or “tend to create a monopoly”) under current U.S. antitrust law. The U.S. government has had merger guidelines since the late 1960s, with the latest version coming in 2010. They aren’t binding law but instead are intended to inform corporations what current law and economic principles are and whether any mergers under consideration might run afoul of them. Past merger guidelines have been widely accepted and relatively uncontroversial—even among litigants arguing about specific mergers in court.

The new Biden administration rules are, to put it nicely, a different approach to such matters.

As we’d expect, the guidelines, 13 in all, reflect the Biden administration’s desire to aggressively regulate supposedly “anti-competitive” business activities and, in particular, to move away from a legal standard centered on “consumer welfare” to a broader and more subjective one that considers many factors, including “bigness” itself. But, as we’ll discuss today, these guidelines are no mere incremental shift toward more merger enforcement under current antitrust law—they’re a radical departure from that law and the economics and recent history of mergers in the United States. And they’re a perfect encapsulation of why antitrust hawks’ knee-jerk “Big is Bad” mindset is so misguided.

What the Guidelines Say

I’ll leave it to legal scholars and others to explain how the proposed rules ignore established antitrust law and instead seek to revive discredited legal doctrines—especially the Supreme Court’s ridiculous Brown Shoe decision from the 1960s (a longtime “example of how not to do antitrust”)—from a bygone era. And if you want a rundown of all 13 guidelines, former FTC official Alden Abbott has you covered.

Today, however, we’ll just be looking at how the guidelines treat mergers and concentration (i.e., the number of producers/sellers in a certain market). In this regard, the guidelines would significantly expand the number and types of corporate transactions at risk of antitrust challenge by doing three things: 1) dramatically lowering the technical threshold—Herfindahl-Hirschman Index (HHI)—for deeming a market “concentrated” or “highly concentrated” (and, per the guidelines, subject to government intervention); 2) adding new rules that deem certain types of mergers—e.g., when a merger creates a new firm with more than 30 percent market share—to be automatically impermissible, regardless of the overall level of market concentration or other factors; and 3) perhaps most important, flipping the current burden (which is on the government to prove that a merger is anticompetitive) to one where there’s a “structural presumption” against any mergers where these concentration factors exist—a presumption that, economist Brian Albrecht notes, probably couldn’t be rebutted by the standard “consumer welfare” defenses.

Albrecht sums up the implications of these and related changes to U.S. merger enforcement (emphasis mine):

The ultimate takeaway here is that the new concentration threshold guidance presents firms with a gauntlet to run if they want to make a deal. No doubt, combining the change in the burden with lower levels of acceptable concentration creates a recipe for many more blocked mergers. Notice I didn’t say anticompetitive mergers. Rather, this will just stop more mergers of every kind without regard for economic argument or recent law.

Put simply, if you’re a U.S. company considering a merger that might trip any of these now-raised concentration wires, just stop considering it—regardless of whether it’s actually “anticompetitive” or whether it might deliver big value to American consumers and the economy more broadly. (Journalists and other experts, including practicing antitrust lawyers and center-left Democrats like Jason Furman and Larry Summers, agree with this take.)

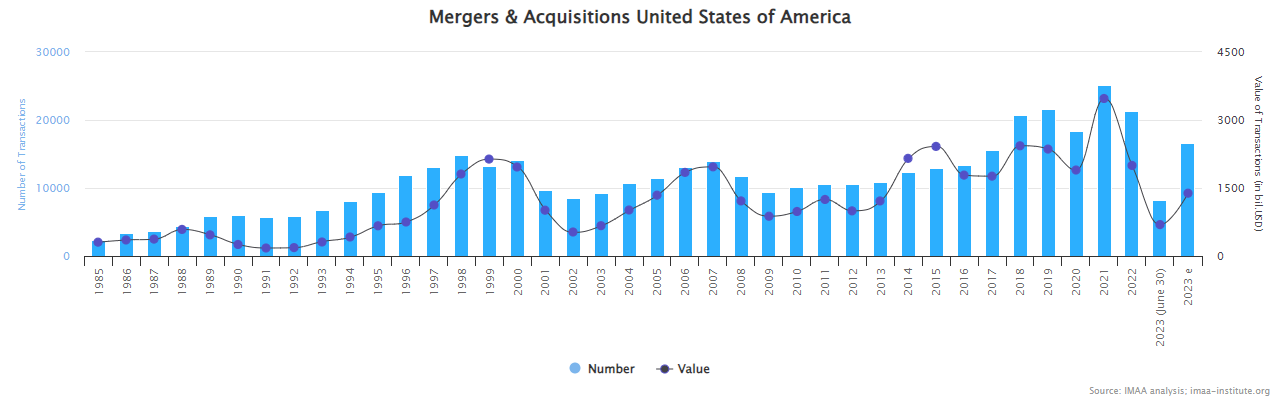

According to the nonprofit Institute for Mergers, Acquisitions & Alliances, there were more than 21,000 corporate mergers and acquisition (M&A) transactions last year, collectively valued at almost $2 trillion—down a bit from 2021’s records, but still massive.

It’s hard to say many of these would’ve been affected by the new guidelines (maybe thousands each year), but it’s clear that the Biden administration wants to insert itself much more deeply into this huge, dynamic market.

And for little good reason.

Bigger Doesn’t Always (or Even Usually?) Mean Badder

Indeed, the guidelines’ reliance on concentration and “bigness” and presumption that many mergers raise anti-competitive problems suffer from several basic flaws. First and perhaps most obviously, mergers—even really big ones—don’t ensure that a firm will suddenly become an unstoppable, anti-competitive force in a market and sometimes, in fact, can spark a once-thriving company’s downfall. Consider, for example, the much-publicized and now-bankrupt Yellow trucking, which in the 2000s was the top dog in the “less than truckload” (LTL) market and bought its biggest rival, second-ranked Roadway, in 2003 and then bought another big LTL rival, USF, two years later. At the time of the Roadway merger, analysts estimated that that the merged entity would control “58 percent of the total market for long-haul shipments of loads that are less than a full truckload,” and the transaction did receive some initial antitrust scrutiny and “unusual attention” in the press because, as one DOJ staffer put it, it was the “biggest trucking merger in the history of the known universe.” But DOJ signed off on the merger because, even with those scary market share figures, they saw little risk of an unstoppable “Yellow monopoly”—there was excess capacity in the market and plenty of available alternatives that would protect consumers from high prices or diminished service.

Turns out, they were right. In fact, as a 2012 Wall Street Journal piece explained, the Roadway merger itself turned out to be a longstanding anchor for the company (emphasis mine):

The 2003 merger which combined two major trucking firms, Yellow and Roadway, should have created a monster of the highway. Instead, as is often the case with large deals, the $1.05 billion merger turned into a monster headache that took years to finalize, partly because of a difficult combination of IT systems and staff. That headache continued on Friday as the company asked its creditors to help it stave off bankruptcy by amending the terms of a 2011 loan agreement. The company also skirted a bankruptcy filing in 2009.

The mergers, the Journal adds this week, also left it bulging with debt—debt that (along with other things like union contracts) is now a big problem. Other famed tie-ups—Daimler-Chrysler and AOL Time Warner come to immediate mind—have proven similarly nettlesome. (Here’s a nice list of other mergers that turned out to be “flat-out disasters.”)

Second, successful mergers—as opposed to the ones above—often increase efficiencies at the new firm and thus generate consumer benefits like lower prices, more variety or geographic coverage, or new and innovative products. As Albrecht notes in a separate op-ed (and as decades of research has shown), these gains are most easily seen in vertical mergers, in which a firm like Apple acquires a complementary company like FingerWorks, whose touchscreen technology paved the way for the original iPhone. “These gains,” he adds, “are one reason economists, the courts and the agencies—before this administration, at least—have been much more positive about vertical mergers.” That group includes, by the way, Furman and now-director of the FTC’s Bureau of Economics Aviv Nevo, the latter of whom—prior to joining the agency—acknowledged in public comments that the economic “consensus would be to recognize that vertical mergers do have a more natural and fundamental relationship with the potential for merger-specific benefits or efficiencies.” (Gee, what changed?)

But big horizontal mergers can also benefit consumers, as the FTC and DOJ acknowledged back in 2006:

Mergers between competing firms, i.e., “horizontal” mergers, are a significant dynamic force in the American economy. The vast majority of mergers pose no harm to consumers, and many produce efficiencies that benefit consumers in the form of lower prices, higher quality goods or services, or investments in innovation. Efficiencies such as these enable companies to compete more effectively, both domestically and overseas.

Plenty of papers have found that horizontal mergers confer these and other benefits. Albrecht points to another one, on power plants, showing that “high-productivity firms buy under-performing assets from low-productivity firms and make the acquired asset almost as productive as their existing assets after acquisition.” Is this always the case? Of course not. But that such benefits regularly result from horizontal mergers strongly caution against a rule to automatically prohibit them when a level of market share or concentration is reached. (Indeed, evidence shows that the same corporate efficiencies that allow firms to benefit and attract customers also regularly breeds the very concentration that the merger guidelines disdain. Conundrum!)

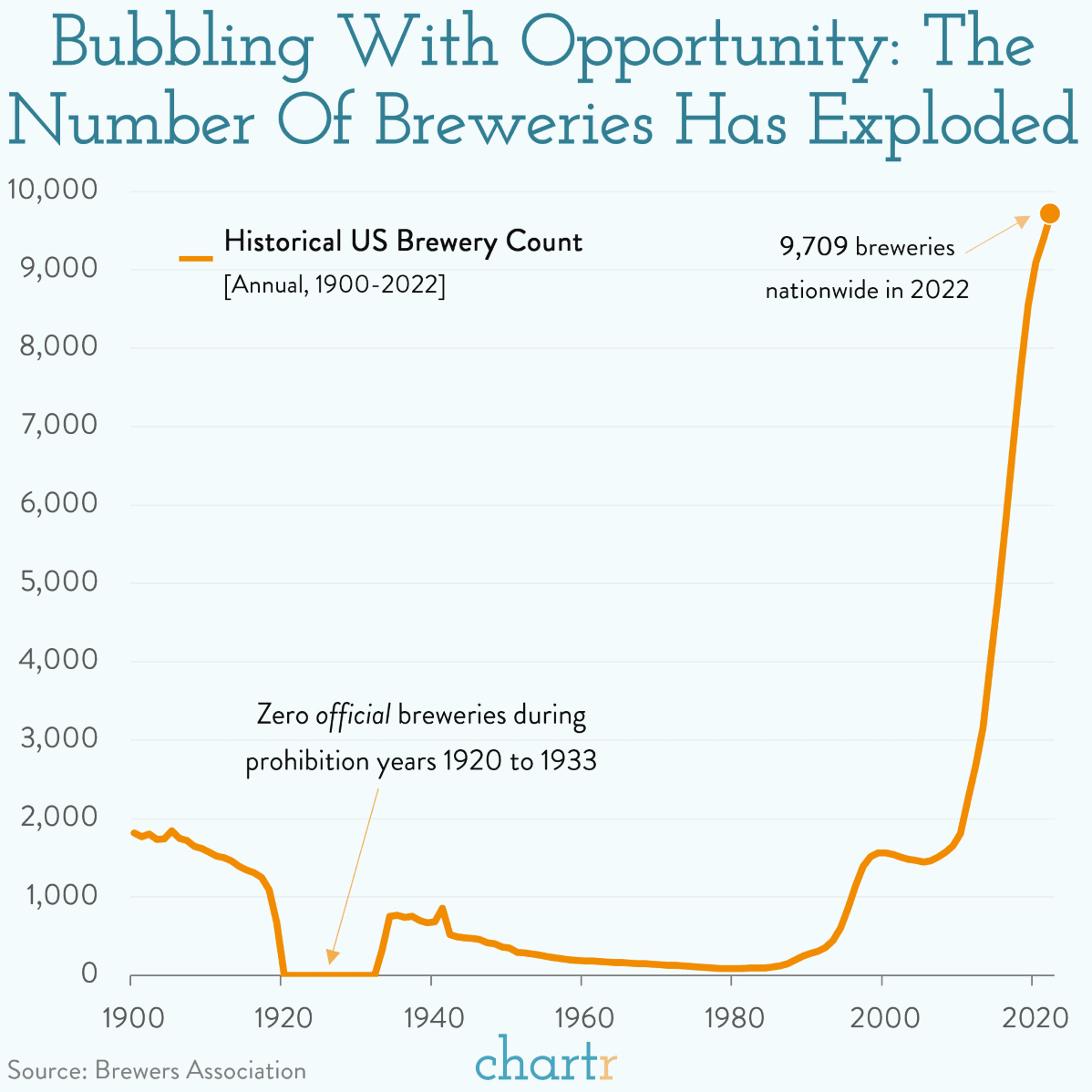

Third, mergers can improve markets—even supposedly concentrated ones—in unexpected, pro-competitive ways that don’t involve the merging companies at issue. One of my favorite examples comes from a recent study on the 2007 Miller-Coors merger, which created a giant in the U.S. beer market and lots of new competition from smaller craft brewers. The authors analyzed 1,088 grocery stores across 36 states between 2008 and 2011 and found that, as MillerCoors’ concentration (HHI) increased, so did craft beers’ numbers and market share (and by a substantial amount). They conclude that “craft brewers’ entry was made easier by the consolidation of commercial brewers,” who raised their prices but, in so doing, “facilitated entry by small new firms since consumers facing higher prices of incumbent products may be more willing to purchase products that recently entered the market.” (Price signals win again!) Eventually, these new market entrants took back market share from big, bad MillerCoors, even when it was enjoying an all-time high level of concentration in a particular local market. In that case, competition actually increased: “The response of craft brewers was to continue entering the market to solidify their differentiation strategy, having a positive effect on their market share, and that the markets that were most affected by the merger saw a larger increase in the number of craft brewers.”

Since then, after several other big corporate beer mergers, the U.S. beer market has continued to diversify:

And the rest of the adult beverage market has diversified too, as “consumer preferences have evolved.” So today beer competes with not just wine and spirits, but also kombucha, hard seltzer, CBD/THC drinks, nonalcoholic offerings, and other things I don’t touch (because I’m old). It’s a tippler’s paradise.

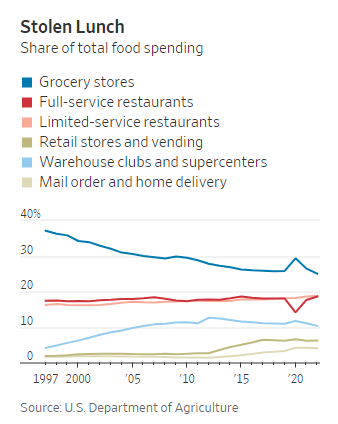

Lest you think this is just about the beer market and macro/microbrews, a similar thing occurred in the U.S. grocery store market:

A study published in 2016 by economist Peter Arcidiacono and others examining Walmart’s impact on grocers in the 1990s and 2000s found that large, incumbent grocery chains competing directly suffered most from its entry, while businesses with completely different offerings—such as those with an ethnic or gourmet focus—actually expanded. And another study published by Lauren Chenarides and others in 2021 showed that when a discount grocer enters a market, sales actually increase for retailers nearby. This could be because consumers are drawn to the discounter as they search for low prices but then finish their shopping at the nearest retailers to find everything else they need. The key is to offer something big-box retailers and discount grocers can’t.

Both examples also get at why so much “big is bad” policy—based on national market share and HHI/concentration data—is misguided. First, topline numbers and rigid market definitions miss hidden variation and consumer alternatives that provide more competition—whether within (e.g., microbrews versus macrobrews; specialty grocers versus supermarket chains) or outside (e.g., kombucha versus beer; restaurants versus grocery stores) the defined market at issue. Second, markets—consumers, producers, investors, etc.—are constantly adapting to new information, including “anti-consumer” things like higher prices or less variety. Combine these with, as we’ve already discussed, the fact that national markets can mask tons of competition and variation in local product markets, and you see why a national merger that looks terrible on paper today (based on yesterday’s data, of course) will look very different next year—especially when you drill down to the local level.

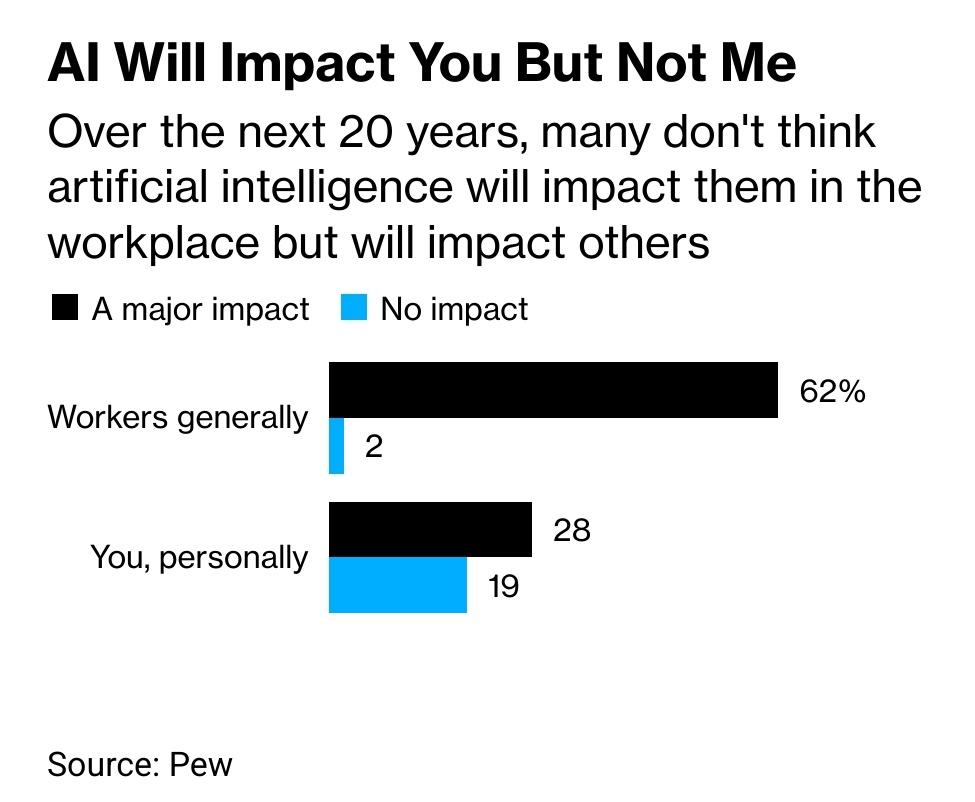

Doom Is Always Obvious and Around the Corner

And this gets to another big problem with a presumption against big mergers: It’s very difficult to predict in advance what will be “good” or “bad” for a company or a market, and, in fact, antitrust hawks have a lousy track record in this regard. Earlier this year, for example, Albrecht and his colleagues at the International Center for Law and Economics* wrote a terrific report documenting some of the biggest “doomsday mergers” that fizzled out—or, like beer industry consolidation, actually improved the market’s competitiveness and consumer surplus—in retrospect. This includes Amazon-Whole Foods, Bayer-Monsanto, Google-Fitbit, Facebook-Instagram/Whatsapp, and Ticketmaster-Live Nation. In each case, antitrust hawks wrongly predicted competitive destruction (e.g., Amazon-Whole Foods) or ignored the merger at the time it occurred and only claimed it was an obvious problem years later (e.g., Facebook-Instagram).

Other mergers or proposed mergers have received similar mistreatment. As CEI’s Wayne Crews notes, for example, various soda company mergers in the 1980s were going to destroy the retail “carbonated soft drink” market, ignoring all the other types of nonalcoholic drinks in the market (which is today more diverse than ever). Regulators almost blocked the Sirius-XM merger in 2008, never imagining today’s streaming media environment. The Staples-Office Depot merger, by contrast, was challenged in 1997 and finally blocked by a federal judge in 2016—years after e-commerce and big box retail had rendered the whole thing laughably moot. (It was a bad case in 1997 too, by the way.)

To be fair, this shoddy track record isn’t because regulators and antitrust hawks are stupid—it’s because, as AEI’s Mark Jamison put it, they have a nearly impossible task, especially in dynamic sectors like technology (on which, of course, hawks focus most):

Experts forecast merger effects using rearview mirrors, but then markets create unexpected realities…. [M]erger analysis seeks to identify whether the merged firm would adversely affect consumers. It does this by looking for symptoms of market power, such as high profits or large market shares. This functions similarly to how doctors sometimes diagnose illnesses—by observing symptoms and then conjecturing the underlying illness, if any.

For horizontal tech company mergers, in particular, this approach to antitrust regulation often registers them as false positives for consumer harm. Tech breakthroughs shake up the market constantly. It is this speed at which innovation disrupts existing market dynamics and share that makes it nearly impossible to assess the boon or harm a merger might have on consumers. Tech firms and startups compete for these breakthrough innovations, so the rapid change defies the notion of enduring market power. In the tech industry, profits and market shares alike are flawed telltales since they are stochastic and their causes are numerous. Resource scarcity, efficiency, innovative design, and exogenous shocks can often create profits and market shares without an ounce of monopolistic firm behavior.

Summing it All Up

None of this means that every merger works out well for consumers or markets or that there should be no regulation (we can debate that another day), but it does, as the ICLE authors explain, demand regulatory prudence, an acknowledgement of mergers’ real-world tradeoffs, technical precision, and lots of evidence. It demands, in short, fewer sledgehammers and more scalpels, especially given the real harms—and no, not just to CEOs, bankers and lawyers—that can arise from preemptively blocking these private transactions.

An almost-irrebuttable presumption against many mergers clearly falls into the “sledgehammer” camp. The only bright side is that, given ample case law contradicting the guidelines and the Biden administration’s losing record in court, few people will pay attention to them.

*Disclosure: Mrs. Capitolism works for ICLE, but—and trust me on this—she’d never think of pitching me on their (great) work and would, in fact, roll her eyes at the mere thought of me being important enough to be pitched.

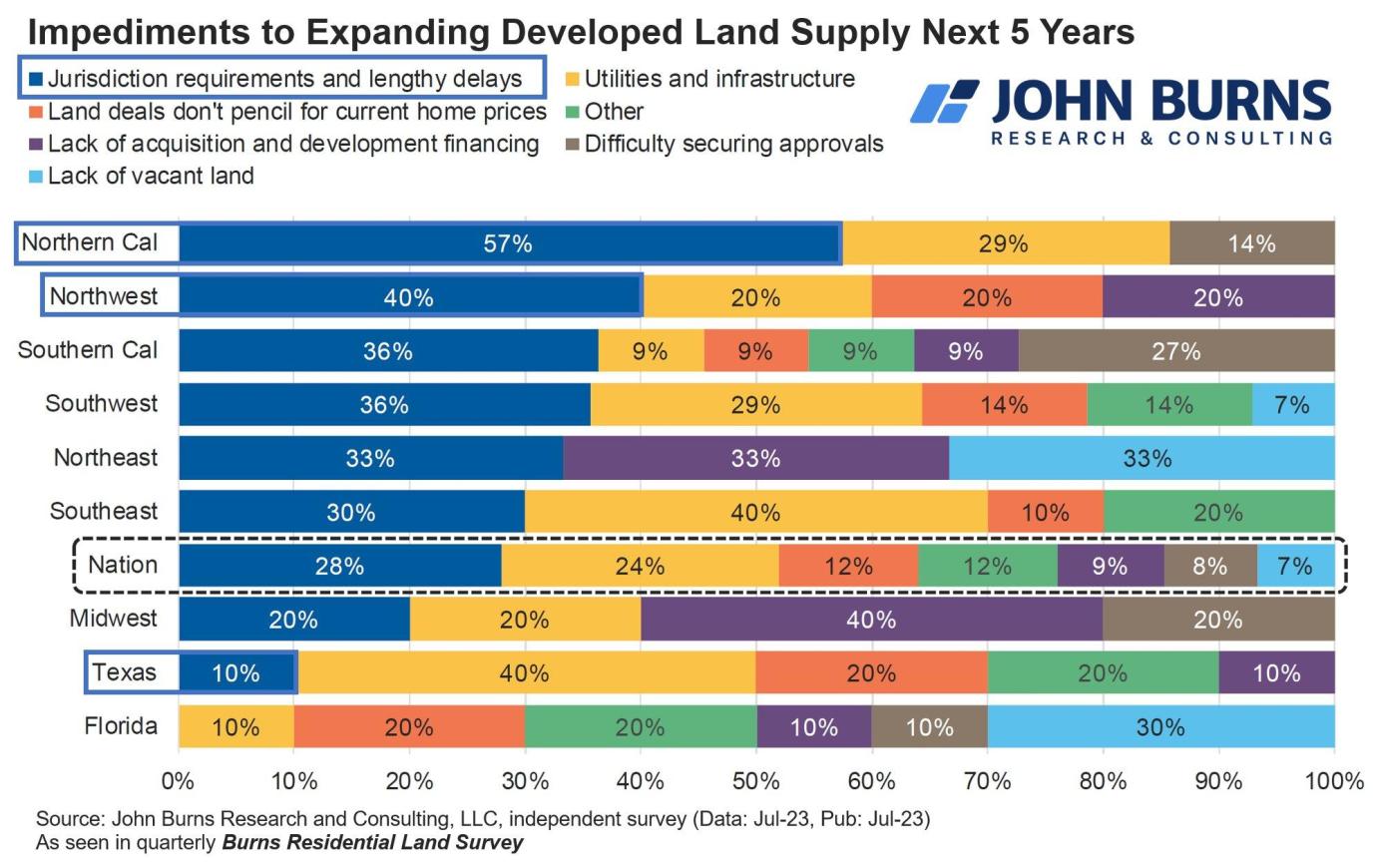

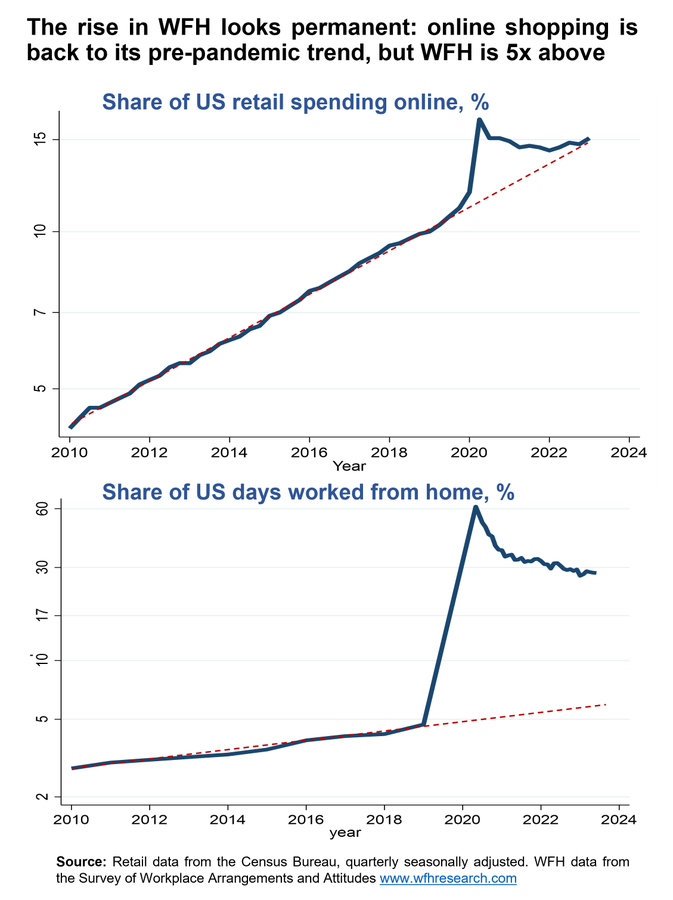

Chart(s) of the Week

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.

With your membership, you only have the ability to comment on The Morning Dispatch articles. Consider upgrading to join the conversation everywhere.