Dear Capitolisters,

A minor travel industry scandal—to the extent such things exist—erupted last week when the Canadian government extended its pandemic-related moratorium on foreign port arrivals, thus imperiling U.S. cruises to not only coastal Canada (which is delightful) but also Alaska. This prompted immediate outrage from Alaska’s congressional delegation, given the numerous jobs at stake in tourism-reliant places along the Alaskan coast. Tellingly unmentioned by the congresscritters, however, was why cruises run by American companies, primarily serving Americans, and both starting and ending at American ports even need to stop in Canada in the first place. The reason: Laws regulating “cabotage”—a fun word meaning “the right to operate sea, air, or other transport services within a particular territory”—dramatically restrict the transport of goods and people between domestic ports. This causes all sorts of problems, which Alaska’s senators and representatives, all of whom support those laws, would rather not discuss.

But discuss them we will, and in the process draw some broader lessons about American industrial policy and trendy efforts to make producers, not consumers, a central focus of U.S. economic policy.

The Cabotage Laws

The United States’ stranglehold on coastwise shipping and transportation has been implemented through several laws, each supposedly passed to boost the domestic shipbuilding industry and, by extension, national security. Shipping restrictions actually date back to the founding, when Congress in 1789 placed prohibitive tariffs on the use of foreign ships in domestic trade in order to support local shipyards and the fledgling U.S. Navy. Cabotage laws have since been refined and expanded several times, with the two most prominent laws in force today being the “Jones Act” and the Passenger Vehicle Services Act (PVSA):

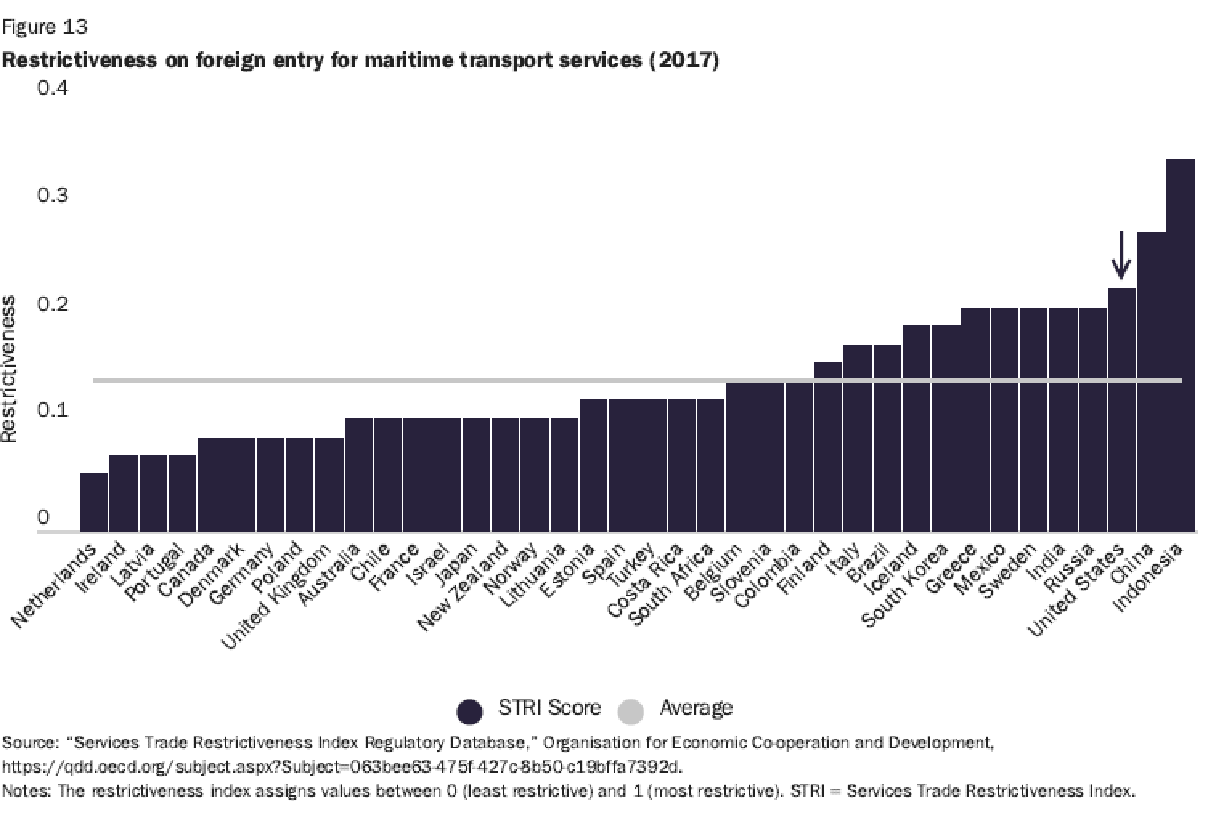

The Jones Act. The Merchant Marine Act of 1920 was presented as a plan to ensure adequate domestic shipbuilding capacity and a ready supply of merchant mariners in times of war or other national emergencies. Section 27 of the law—the “Jones Act”—revised existing U.S. cabotage laws and today restricts the domestic shipping of waterborne goods to vessels that are U.S.-built, U.S.-owned, U.S.-flagged, and U.S.-staffed. As a result of the Jones Act, the United States has one of the most (if not the most) restrictive shipping systems in the world:

The PVSA. The PVSA was passed in 1886 and applies essentially the same restrictive rules to waterborne transportation of passengers, instead of goods. Thus, cruises between two U.S. ports (with no international stops in between) are restricted to vessels that are U.S.-registered, U.S.-built and (mostly) U.S.-crewed and owned.

Similar laws apply to salvage, towing, and dredging—each intended to boost the U.S. shipbuilding industry, the merchant marine, and national defense.

The Economic Harms and Failed Objectives

As summarized in a 2018 Cato Institute paper, U.S. cabotage laws have imposed substantial economic costs while utterly failing to produce a vibrant domestic shipbuilding industry and workforce, or a thriving merchant marine.

First, Jones Act restrictions have inflated U.S. shipping costs because the transport of cargo between U.S. ports and on inland waterways is off-limits to foreign competition. Estimates of the direct economic damage vary widely, ranging from about $650 million to almost $10 billion per year, because the act has so distorted the U.S. market that it’s difficult to construct a “free market” counterfactual. One of the most recent and comprehensive analyses, by the OECD, found that repeal of the Jones Act would increase U.S. domestic output by $40 billion to $135 billion, thanks primarily to increased industrial activity in other sectors: reduced freight rates would stimulate demand for intra-national trade (via U.S. waterways), thus generating economic growth. These harms are particularly acute for places that lack alternative means of transport, such as Hawaii, Alaska, and Puerto Rico, and are a core reason Jones Act restrictions were often waived during times of crisis (e.g., Hurricane Maria in 2017).

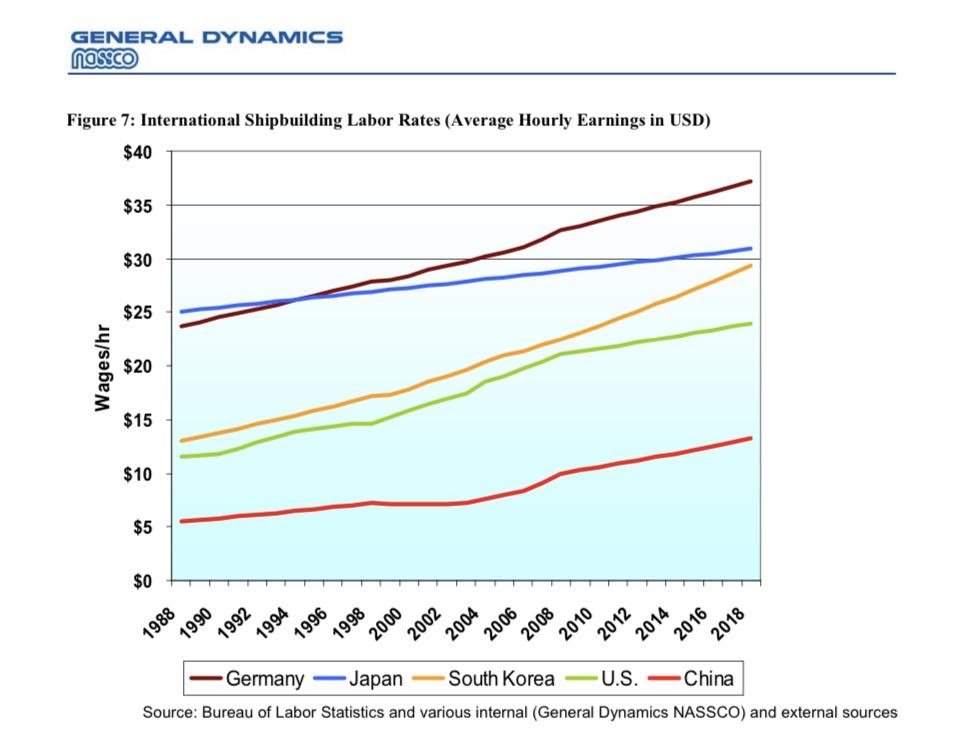

However, the OECD report also shows how the Jones Act hurts the U.S. commercial shipbuilding industry, which is struggling mightily despite (or, more likely, because of) government protection. It is estimated that a U.S.-built, Jones Act-compliant ship costs four to five times as much to build as a ship made abroad, even though U.S. shipbuilding labor rates are relatively low:

These eye-popping numbers show why foreign subsidies—long an excuse for the Jones Act’s restrictions—are relatively meaningless: leaving aside lower U.S. labor rates and the fact that domestic shipyards receive multiplefederal, state, and local subsidies themselves, variousestimates indicate that Chinese, Korean, and other subsidies improve foreign ships’ price-competitiveness by up to 25 percent. That might sound like a lot, until you recall that U.S. ships are around 400 percent more expensive than foreign ships, hence why the U.S. industry balked at a 1990s international agreement to pare back global shipping subsidies. Indeed, American shipyards are so uncompetitive that U.S. ships get routinely serviced abroad, even though such repairs are subject to a 50 percent tariff.

A recent paper from my Cato colleague Colin Grabow explained why U.S. ships are so dang expensive:

The Jones Act’s U.S.-build requirement has incentivized American shipyards to orient themselves away from the competitive international market and toward this captive domestic shipbuilding market. This, in turn, means reduced output (a mere two or three oceangoing ships per year), less competition, and the failure to develop a specialized market niche. All of these missing elements are vital to increased productivity and lowered costs.

In short, cabotage restrictions have created a vicious cycle of ever-worsening domestic shipyard competitiveness: higher prices for U.S. ships depress demand for shipping services, thereby leading U.S. companies to purchase fewer American-made vessels. Producers, in turn, build fewer ships, thus preventing economies of scale and specialization and thereby making U.S. shipyards even less competitive (and more expensive) going forward. Rinse and repeat until you have the zombie industry we see today.

By contrast, the OECD estimates a repeal of the Jones Act would increase domestic shipbuilding demand, output, and final value-added by hundreds of millions of dollars per year. In other words, it would actually benefit the U.S. industry!

Without reform, those companies will inevitably continue to decline, and current trends are especially bleak for oceangoing vessels (i.e., the ships that the U.S. military would need in wartime):

Nearly 9 of every 10 commercial vessels produced in U.S. shipyards since 2010 have been barges or tugboats. Among oceangoing ships of at least 1,000 gross tons that transport cargo and meet Jones Act requirements, their numbers have declined from 193 to 99 since 2000, and only 78 of those 99 can be deemed militarily useful. Even in their expressions of support for the Jones Act, government officials concede that the U.S. shipping industry and its associated ecosystem have been depleted.

The Jones Act fleet is not just shrinking but also increasingly decrepit because replacement costs are so high. Of the mere 98 ships now in service (we’ve lost once since the quote above was published), more than one-third (34.7 percent) are past the age of 20, and a quarter of them (24.5 percent) are past 30. Ridiculous examples abound, like this barge on the Great Lakes built in 1907, or this dredger built during WWII. Studies also show that these old vessels are not only inefficient but also dangerous.

The PVSA has had similar results: large, American-made oceangoing cruise ships are essentially nonexistent due to a combination of high prices and ineptitude. Indeed, there is only one large cruise ship—the hilariously-named Pride of America—operating under the PVSA (in Hawaii), but it’s a sad example of America’s cabotage problem:

In 2001, powerful Southern senators arranged for U.S. taxpayers to subsidize a shipyard in Mississippi so it could build a cruise vessel. It tried, and it failed. Within a year, a bungled, half-completed hull was declared “unfloatable” and was towed across the Atlantic to be completed in Germany for Norwegian Cruise Lines. But to avoid embarrassment to the U.S. government, the ship is still billed as “Made in America” and is free from the [PVSA rules].

As this New York Times piece on the Pride of America’s sordid (and expensive!) history makes clear, that ship is not exactly something to be proud of. (In fact, no large cruise ship has been built in the United States since 1958, and that ship, the SS Argentina, needed major federal subsidies.)

With fewer (and older) ships, fewer workers, and fewer (and increasingly uncompetitive) shipyards, U.S. cabotage laws have undoubtedly failed to achieve their economic and national security objectives—a conclusion made evident by the fact that U.S. carriers now turn to Chinese and other foreign shipyards for maintenance of Jones Act vessels, and that the U.S. military during the Gulf War relied heavily on foreign-built ships to meet its sealift needs. (Only 29 of 191 dry cargo ships, for example, were U.S. flagged, and we even asked the Soviets—the Soviets!—for help.)

The Unintended Consequences

Our cabotage laws have also unsurprisingly spawned a host of unintended consequences. For example, higher shipping costs caused by the Jones Act increase demand for alternative forms of transportation, including trucking, rail, and pipeline services, raising those modes’ rates and inflating business costs throughout the supply chain.

As noted above, this imposes a significant cost on the economy and specifically the operations and finances of U.S. manufacturers that are involved in complex supply chains (and thus do a lot of shipping).

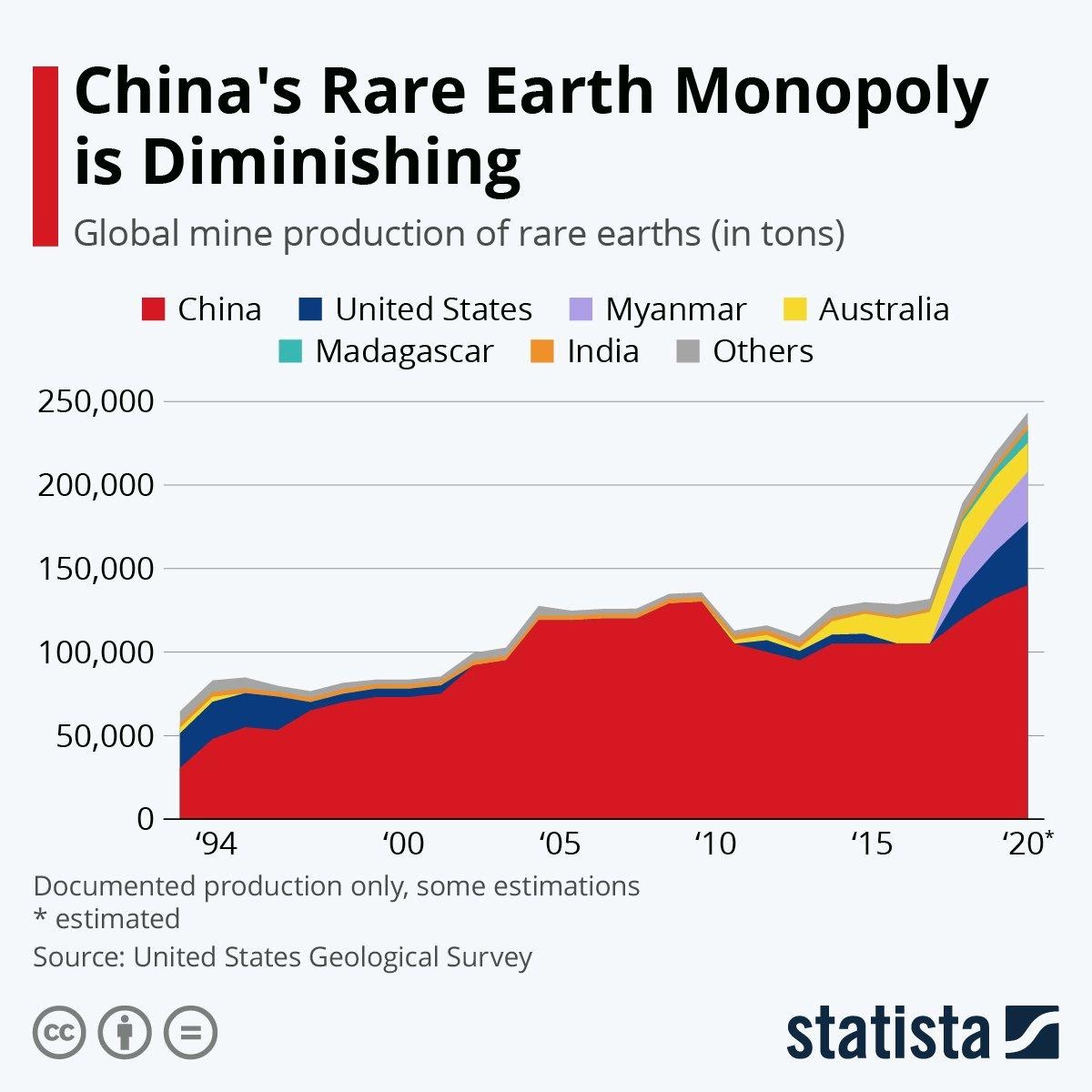

By raising domestic companies’ shipping costs, the Jones Act and related cabotage laws disadvantage these producers relative to their foreign competitors, meaning potential lost sales to lower-priced alternatives. Such transactions not only deny U.S. companies business, but also can undermine national security where the foreign producers at issue are in hostile places. For example, Russian and other foreign gas producers often service Northeastern U.S. cities like Boston due to the artificially high cost of shipping liquified natural gas (LNG) from Texas, Louisiana, and even nearby Cove Point, Maryland. (There are a grand total of zero Jones Act LNG tankers.) Puerto Rico, meanwhile, buys rice from China and jet fuel from Venezuela.

If American producers can successfully pass on higher costs to U.S. consumers, on the other hand, then the resulting higher prices consume funds that U.S. households could have saved, spent, or invested elsewhere in the economy (likely on more productive ventures). This, again, hurts those consumers and the economy more broadly.

Heightened use of trucks and freight trains means more wear on aging U.S. infrastructure (roads, rail lines, etc.), as well as increased environmental costs (surface transportation emits more carbon than ships and barges). It also raises safety issues (e.g., transporting toxic materials on U.S. highways) and increases traffic congestion—especially on highways running parallel to U.S. sea lanes—thereby costing American commuters time (possible wages/output or leisure). The Jones Act also will raise costs for offshore wind projects, discouraging their implementation and, by extension, Biden administration climate goals.

The PVSA causes other unintended problems. For example, U.S. cruise lines will detour to foreign ports in order to escape the PVSA and use foreign-built ships. Thus, cruises from California to Hawaii might stop in Ensenada, Mexico or Vancouver, Canada—both thousands of miles out of the way and thus wasting time and fuel while increasing pollution. And, as we saw at the beginning of the newsletter, cruises that start or end in Alaska will also hit a Canadian port.

Alternatively, U.S. cruise lines simply avoid the United States altogether, choosing instead to depart from Canada or Mexico and thus depriving U.S. ports of revenue and jobs:

The cruise docks of San Diego sit vacant 90% of the year. Meanwhile, 80 miles south, Ensenada receives more than three times as many passengers as San Diego, and many more than New York, New Orleans and Boston. Vancouver hosts three times as many sailings as Seattle.

Without the PVSA, many of those cruises would start in America, thus generating jobs—at the port or in taxis, hotels, and restaurants—and economic growth at home instead of in foreign countries. One recent study by the state of California, for example, found that PVSA repeal would dramatically increase total passenger visits to California and related port calls, thus increasing industry revenues, jobs, payrolls and taxes, while doubling longshore positions supported by the cruise industry. No wonder the Canadian government has reportedly lobbied to keep the PVSA.

Even where the cruise still starts in the U.S. and the line is straighter, such as for Alaskan cruises that stop in Canada, the current pandemic-related port closures show the risks of having a multibillion-dollar U.S. cruise industry rely on other countries’ hospitality. Unless Canada relents or the U.S. Congress amends the PVSA, Alaska’s 2021 cruise season—and all the Alaskan jobs and businesses it supports—will be effectively canceled.

And then there are the “true absurdities”:

When a collision on the Mississippi led the U.S. Coast Guard to close access to the river in February 2004, two Carnival cruise ships that had left from New Orleans were forced to divert to Gulfport, Miss., and Mobile, Ala. The ships had nothing to do with the crash. Nonetheless, U.S. Customs and Border Protection authorities fined the company $2.8 million for daring to show up at the docks in Gulfport and Mobile and thereby violating the PVSA.

Finally, U.S. cabotage laws have been a persistent irritant to important U.S. trade partners and are frequently exempted from U.S. trade agreements. Because trade negotiations are always reciprocal, U.S. intransigence on cabotage means other countries are less willing to make important market access concessions for American exporters and investors. These economic harms further undermine, rather than support, the U.S. economy and national security.

So Why Are These Laws Still Here?

Despite U.S. cabotage laws’ numerous failures, they not only persist but have actually been strengthened over the years, even as costs have skyrocketed. For example, the Congressional Research Service notes that U.S.-built ships’ price premium increased from 20 percent in 1922 to 50 percent in the 1930s, doubled in the 1950s, tripled in the 1990s, and is now four-fold or five-fold. Congress’ response to this growing differential? Tightening the cabotage laws by, for example, expanding the U.S. build requirement to commercial fishing vessels in the late 1980s, and just last year curtailing the executive branch’s ability to issue Jones Act waivers during times of emergency.

The government’s actions are a classic case of Public Choice Theory in action: Because U.S. cabotage laws deliver concentrated benefits to a handful of U.S. producers, unions, and ship-owners while imposing diffuse costs upon a much larger group of consumers, the former is willing to expend the time, effort, and money to advocate (lobby) for these laws while the latter isn’t willing to do the same against them (if it even notices them at all). Put simply, pro-cabotage groups derive tens of millions of dollars in cabotage “rents” from the government, so spending a few million on lobbying is a great investment. Consumers, by contrast, often don’t pay attention to or lobby against these laws because the cost of doing so would far exceed any potential benefits that reform or repeal might deliver.

This dynamic produces three (at least) bad outcomes, all of which tend to accelerate over time:

A well-organized and highly motivated domestic lobbying and public relations machine whose singular focus is to oppose all possible cabotage reforms and consider ways to receive even more rents from legislators and the bureaucracy. The Jones Act lobby is notoriously active and influential, and there is even a think tank—the “Transportation Institute”—whose board of directors is composed of Jones Act shipping executives and whose “corporate office” is located in the parking lot of the Seafearers International Union. Unsurprisingly, there is no countervailing lobbying force in Washington. (Although some other U.S. business groups, such as the oil industry, occasionally lobby against the Jones Act, they have other interests.) As noted above, moreover, the laws’ unintended consequences also create other concentrated benefits, and thus rent-seeking interests like the pro-PVSA Canadians.

Significant support from elected officials—even ones in places like Alaska and Hawaii that are disproportionately harmed—who are primarily interested in re-election (instead of the “public interest”) and thus respond logically to the domestic interest groups (i.e., the shipbuilders and unions) that are located in their districts/states and have established cabotage support as a litmus test for votes and campaign contributions.

A regulatory apparatus that, due to longstanding/frequent interaction and congressional pressure, has been “captured” by the very entities it regulates. In this case, there is ample evidence that both the Department of Transportation and its Maritime Administration are, as Grabow recently put it, “properly viewed as taxpayer‐funded Jones Act lobbyists.”

These issues were on full display in 2019 when President Trump’s staff proposed a 10-year Jones Act waiver for transporting liquified natural gas, given the size of the U.S. oil and gas industry, the lack of U.S.-flagged LNG vessels, and the various geopolitical implications. Despite support from Trump’s economic and national security teams, the waiver plan died on the vine after vigorous lobbying from the domestic industry, members of Congress (who didn’t even know what they were opposing!), and Transportation Secretary Elaine Chao, who was subsequently named the American Maritime Partnership’s inaugural “Maritime Hero”:

Yes, you heard that right: They made up an award and, in delivering it, compared Secretary Chao to WWII vets. It’d all be funny if it weren’t, you know, not really funny at all.

Summing It All Up

Centuries of U.S. cabotage laws have not only caused high prices and a host of unintended (occasionally ridiculous) consequences, but also presided over (if not caused) the steady decline of American shipbuilding competitiveness and the embarrassing degradation of the merchant marine fleet. As a result, cabotage laws have undermined the very national security objectives they were supposed to support. But instead of reforming these policies to account for radical changes in the U.S. industry and global manufacturing supply chains since the 1700s(!), Congress and the administrative state have doubled down on an increasingly uncompetitive industry, due in large part to the immense resources that domestic shipyards, unions and shipowners devote to lobbying and P.R. (instead of productive things like research and development, capital expenditures, or skills upgrading). Even today, the suggested solution to our maritime problems is to … further expand U.S. cabotage laws. Sigh.

As depressing as the situation is, however, here’s a silver lining: As I explain in my latest paper, U.S. cabotage laws are a fantastic example of the perils of local content restrictions and “producer-centric” economic policy more broadly, both of which have become fashionable again, especially on the populist right. Here, we see:

How government protection and support of a particular industry can both be costly for consumers (companies and individuals) and discourage, rather than encourage, that industry’s innovation and growth–creating “zombie firms” that devote their resources to the political process instead of the industrial process.

How industrial policies can have a host of harmful—and often absurd—unintended consequences that are usually not included in accounts of these programs’ costs.

How the political and regulatory process inherently disadvantages diffuse groups of taxpayers and consumers, and thus why the law should be strongly biased in these groups’ favor to check stronger, more organized interest groups who would disproportionately benefit from government support (in amounts that far exceed the cost of lobbying for it).

How government policy is less likely than private markets to discipline failure and may, in fact, reward it.

None of this, of course, means that free markets are perfect or that government support is never needed. But more than a century of U.S. cabotage failure does (I hope) show the perils of an economic policy that elevates the interests of certain producers and workers over those of consumers and other industries, even, or perhaps especially, where “national security” is involved.

Chart of the Week

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.

With your membership, you only have the ability to comment on The Morning Dispatch articles. Consider upgrading to join the conversation everywhere.