Turn any article into a podcast. Upgrade now to start listening.

Premium Members can share articles with friends & family to bypass the paywall.

Editor’s Note: For the week leading up to Thanksgiving, we’re unlocking The Morning Dispatch for everyone—no paywalls. If you’re a new reader or are on the free list, we hope you enjoy the complete TMD experience. And if you’re a member, thank you for your support. We hope you’ll consider forwarding these next few editions to friends and family you think would value our work.

Happy Thursday! United Talent Agency has signed Parmigiano Reggiano—yes, the cheese—to its roster. We look forward to a Cheese Cinematic Universe of blockbuster movies and hope parmesan becomes the first food to win an Oscar.

Quick Hits: Today’s Top Stories

- The U.S. trade deficit dropped 24 percent in August, mainly due to President Donald Trump’s tariff policies, according to a Commerce Department report released on Wednesday. The difference between the value of goods the U.S. imports from other countries and the value of its exports was $59.6 billion in August, down from $78.2 billion in July. The change was driven by declining imports, which fell by 5 percent, compared with a 0.1 percent increase in exports. Also on Wednesday, the Bureau of Labor Statistics confirmed it will not publish the October jobs report due to the federal shutdown and will delay the release of the November numbers. It will release the September job numbers today, seven weeks late. Additionally, publicly released minutes from the Federal Reserve’s October meeting showed significant disagreement about whether to cut interest rates in December or hold them steady.

- On Wednesday, Axios reported more details of the White House’s proposed 28-point peace plan to end the war in Ukraine. The plan was drafted in consultation with Russia and reportedly calls for Ukraine to give up land that it currently controls, and to limit the size of its military, in exchange for security guarantees from the U.S. Ukrainian President Volodymyr Zelensky reportedly is not interested in discussing the plan and has asked to discuss a Ukrainian proposal in a meeting that includes European partners. Meanwhile, Ukraine confirmed it had used long-range Army Tactical Missiles Systems (Atacms) to strike targets inside Russia on Tuesday—its first admission of using the weapons, which rely on U.S. targeting, since President Donald Trump lifted restrictions on their use by Ukraine last month. On Wednesday Britain’s defense secretary stated that a Russian spy ship had entered British waters for the second time this year and had pointed lasers at Royal Air Force pilots who had been tracking its activities.

- The Israel Defense Forces (IDF) claimed that Hamas broke the six-week-old ceasefire agreement yesterday, firing on IDF troops on the east side of the “Yellow Line,” which splits the Gaza Strip between Israeli and Hamas control. In response, the IDF struck Hamas targets across Gaza in a series of airstrikes. No soldiers were killed or wounded in the initial attack.

- Federal prosecutors admitted Wednesday in a court hearing that a full grand jury never reviewed the final indictment against former FBI Director James Comey and that only the foreperson and one other juror did. In a brief filed last night, the Justice Department defended the actions of interim U.S. Attorney Lindsey Halligan when she showed an altered version of an indictment to two grand jurors instead of the entire panel. DOJ attorneys in their brief argued the case should not be dismissed as a result of the issue. Comey’s attorneys argued the issue was enough to throw the case out, but U.S. District Judge Michael Nachmanoff said he needed more time to consider each side’s arguments. A different judge has already criticized the case for having “profound” investigative missteps.

- Nvidia reported record third-quarter earnings on Wednesday, comfortably exceeding Wall Street expectations, with revenue of $57 billion—up 62 percent from a year ago. Nvidia also provided fourth-quarter revenue guidance of $65 billion—$3 billion above forecasts—with CEO Jensen Huang saying demand for the company’s Blackwell chip is “off the charts.” Huang also directly addressed worries about an AI bubble, saying, “There’s been a lot of talk about an AI bubble. From our vantage point, we see something very different.” However, over 60 percent of Nvidia’s sales come from four big customers, and depend on still-unproven bets on generative-AI infrastructure. Shares rose more than 5 percent in extended trading following the announcement, putting the company’s value up 39 percent since the start of the year, at $4.5 trillion. Nvidia alone is 8 percent of the S&P 500’s total market capitalization, and a poor quarter for the company would have significant impacts on the entire U.S. stock market.

Hash It Out

It’s been a bad week for crypto. The value of Bitcoin—which hit an all-time high of more than $124,000 last month—has since slid by 30 percent, erasing almost an entire year of gains.*

Still, there’s never been a better time to be in crypto.

Crypto lobbyists walk the halls of Congress, legislators are working to legitimize blockchain technology as part of the American financial landscape, industry-backed super PACs are stockpiling multi-million dollar war chests for the 2026 midterms, and on Wall Street, traditional banks that once dismissed blockchain as a fad are now racing to offer cryptocurrency products and integrate blockchain technology into their processes. And if that weren’t enough, crypto has the White House.

Since President Donald Trump returned to office, he has pardoned convicted crypto executives, his Justice Department has pulled back from prosecuting crypto firms and investors, and his family has amassed its own lucrative personal crypto empire.

Typically, The Morning Dispatch’s main story is cut off here, with the full item reserved for paying members. We are unlocking the newsletter this week to give free readers a taste of what they’re missing out on. To get the full version in your inbox every day—and unlock all of our stories, podcasts, and community benefits—join The Dispatch as a paying member.

Cryptocurrencies are digital-first tokens whose ownership is marked on collective, highly secure digital ledgers, called blockchains. This has mainly been used to speculate, gamble, and scam, but—with the proper regulatory framework—advocates argue that technologies like decentralized finance (DeFi) platforms and cryptocurrencies could become instrumental parts of mainstream finance, reducing many of the transaction fees and delays associated with traditional finance.

The current Trump administration’s broad embrace of and support for the crypto industry depart substantially from both the Biden administration’s approach and Trump’s earlier public views on cryptocurrency. Back in 2021, Trump called Bitcoin “a scam” and said it should be highly regulated to prevent it from competing with the U.S. dollar. But by the end of 2022, Trump began to change his tone on the emerging technology, even releasing a line of blockchain-powered digital trading cards featuring his own image. By the kickoff of his 2024 campaign for president, Trump was calling himself the “crypto president” and promising the industry that, if elected, he would appoint pro-crypto regulators to key agencies, such as the Commodities and Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC).

Meanwhile, the Biden administration was taking a more hostile stance. Instead of pursuing regulatory reform and offering crypto firms reliable guidance on how to operate legally within existing securities law, under Biden, the SEC and DOJ pursued an aggressive prosecutorial strategy, launching investigations into exchanges like Binance, Kraken, Coinbase, and FTX for suspected violations of securities and anti-money laundering laws. The approach, which critics labeled “regulation by prosecution,” put the industry on the defensive, limiting the growth of new firms and discouraging traditional banks and financial institutions from adopting blockchain technology and products. It also encouraged many in the industry, fearing four more years of a Biden or Harris presidency, to go all in on the Trump campaign, which pitched a comparatively laissez-faire approach. While the industry’s top political action committees did not donate directly to either presidential candidate in 2024, they spent around $135 million supporting pro-crypto congressional candidates, and several high-profile crypto founders personally supported Trump’s campaign.

Since taking office in January, Trump has largely kept his promises to the industry. During his first week, Trump issued an executive order outlining his administration’s intentions to “promote United States leadership in digital assets and financial technology while protecting economic liberty.” In March, he issued a second executive order establishing a “Strategic Bitcoin Reserve” and a “U.S. Digital Asset Stockpile.”

In July, Trump also signed into law the GENIUS Act, a largely bipartisan bill regulating stablecoins—a form of cryptocurrency designed to maintain a 1-to-1 value with an asset like the U.S. dollar—and the first major crypto legislation in American history. Legislators immediately pivoted to what is considered within the crypto industry to be the most substantial legislative project yet—a so-called “market structure,” which will determine the basic regulatory framework for the entire crypto industry. Until now it has relied on antiquated securities laws passed nearly a century ago and commodity frameworks implemented in the 1970s.

“It’s the foundational regulatory framework for how digital assets are going to reach the American people,” Cody Carbone, chief executive officer of the Digital Chamber, a blockchain and digital asset trade association, told TMD. “It’s so critical that we start here and get this, this is the low-hanging fruit.”

Despite the industry’s boom under Trump, crypto firms and traditional financial institutions still face broad legal uncertainty about how to offer digital assets to their customers, which curtails their ability to plan confidently. But if the U.S. can pass a market structure bill clarifying how—and by whom—the crypto industry is regulated, institutional players like commercial banks will finally have the formal go-ahead they need to begin offering crypto custody, trading, and payment services to their customers. “Having that kind of clarity legally from legislation is gonna be huge, and it’s gonna be a huge boon for a lot of financial institutions and investors who want to get more into the space,” Ron Hammond, head of policy and advocacy at the cryptocurrency trading firm Wintermute, told TMD.

That clarity is coming. Last week, the Senate Agriculture Committee, which oversees the CFTC, released a discussion draft of its long-awaited version of the bill that, if passed, would open the door to broader adoption of blockchain technology across the American economy.

But critics remain concerned. “The bill is long on promises and very short on details,” Mark Hays, associate director for cryptocurrency and financial technology at Americans for Financial Reform, told TMD. “If this legislation passes without adequate safeguards for investors and with loopholes that could undermine existing financial regulations, when the next crypto crash comes—and it will come—more of us, even if we don’t invest in crypto, could be negatively impacted.”

That possibility has some on Capitol Hill, particularly in Democratic offices, on edge. But a larger issue for many Democrats is the conflict-of-interest concerns surrounding the Trump family, whose wealth is now, in no small part, tied directly to the fortunes of crypto in America.

Alongside an official memecoin issued by Trump only days before his second inauguration, a Bitcoin treasury announced by the president’s Trump Media & Technology Group, and various cryptocurrency mining projects pursued by the president’s sons, the family is the majority owner of World Liberty Financial. The crypto firm, formed by allies of the president, last year launched a cryptocurrency token that raised more than $500 million in its first several months of sales—which benefited the Trump family directly through its right to 75 percent of the token’s trading fees. In February, the SEC paused a yearslong prosecution against crypto billionaire Justin Sun, only a few months after he purchased around $75 million worth of the token, leading to the first in a string of quid pro quo allegations from opponents of the president.

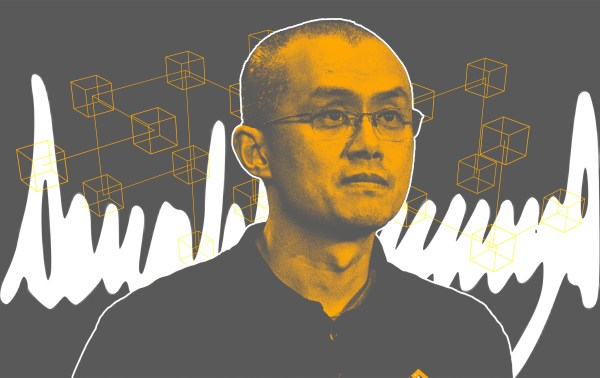

In March, World Liberty Financial also announced the launch of $USD1, a stablecoin pegged to the U.S. dollar and a potential cash cow for the business should it attract broad investment. Two months later, an Emirati state-owned investment firm used the stablecoin to make a $2 billion investment in the crypto exchange Binance, granting the Trump family’s stablecoin legitimacy and providing World Liberty Financial with a substantial nest egg that could generate tens of millions of dollars per year in interest for the Trump family. Simultaneously, Binance founder and former CEO Changpeng Zhao, who pleaded guilty in 2023 to charges of violating the Bank Secrecy Act, began a monthlong lobbying campaign for a pardon from the White House—which he received late last month. The pardon riled up Democrats, including Senate Banking Committee Elizabeth Warren, the ranking member, who saw the move as a conflict of interest and potential quid pro quo from the Trump administration.

Some Democrats are trying to introduce conflict-of-interest provisions into the market structure bill that would prevent the kind of deep industry involvement undertaken by the current White House, but it seems like a long shot. “Who in their right mind believes that the Trump administration is going to sign off on a regulatory framework for an industry that has literally made him billions and that would make that more difficult for him to do?” Hays said.

Crypto lobbyists and legislative staffers also face a time crunch. As the industry faces increasing polarization, its proponents want to avoid stretching the legislative process into 2026, when midterm elections could further politicize the issue. “Can we get a bill across the finish line and to the president’s desk before it becomes a really political season?” Carbone asked. He thinks so, though it won’t be easy. “Even during the shutdown, you were having industry roundtables with both Republicans and Democrats,” Carbone said. “This still remains a priority for these members.”

Industry insiders are hoping to see draft bills marked up by the end of the year, followed by a full Senate vote in February or March. Then the bill will head to the House, and eventually, the industry hopes, to the president’s desk. After that, it will be up to crypto firms, traditional banking institutions, and U.S. consumers to shape the future of America’s digital economy and, most importantly, determine what global leadership in digital assets looks like.

“The United States is a world leader in global markets, but if we fail to act, we’re going to keep seeing more folks go offshore, and that’s going to be a concern, especially when we’re trying to retain the industry’s and the country’s best and brightest,” Hammond said. “This is the time to get it done, and there’s momentum, which is rare in politics.”

Today’s Must-Read

America’s political system is careening toward fiscal collapse, with a calcified political class more interested in protecting their own power than addressing a national debt approaching record highs. Doug Bandow, a senior fellow at the Cato Institute, argues that congressional term limits could break the iron grip of incumbency that keeps reelection rates above 90 percent and transforms even reform-minded legislators into defenders of a status quo they once opposed. Evidence from states shows that term limits reduce government spending growth by up to 46 percent and force politicians to remain accountable before they “go native” in Washington. While not a perfect fix, Bandow believes that term limits would inject competition back into a system where entrenched incumbents have made congressional seats nearly hereditary.

Term limits might sound like an appealing fix for our dysfunctional government, but do they actually make things worse? Anthony Fowler, the Sydney Stein professor in the Harris School of Public Policy at the University of Chicago, argues that term limits undercut democracy itself by preventing voters from reelecting experienced lawmakers they trust. Politicians freed from reelection pressures don’t suddenly become better public servants, he argues—they become less motivated to work hard and please constituents. If we truly believe in democracy, Fowler believes we should trust voters to fire bad politicians themselves rather than tying their hands with blanket restrictions.

Toeing the Company Line

Nixon’s Revenge

Trump’s Republican Party hearkens back to the era of the ‘me-too Republicans.’

Homeland Security’s Fuzzy Deportation Math

The department is painting its removal efforts with broad strokes instead of publishing detailed data.

The ‘Five Eyes’ Are Blinking

The military buildup around Venezuela has prompted allies to stop sharing some intelligence with the U.S.

Democrats Test the Waters on Free Trade

The issue is fraught for the party, but lawmakers and 2028 hopefuls are increasingly critical of President Trump’s tariffs.

In Other News

Today in America:

- President Donald Trump signed the Epstein Files Transparency Act into law yesterday, requiring Attorney General Pam Bondi to publicly release all unclassified documents relating to Jeffrey Epstein within 30 days.

- The Justice Department charged Florida Rep. Sheila Cherfilus-McCormick (a Democrat) with stealing $5 million in federal disaster funds, which she reportedly used to fund her 2021 campaign.

- Axios reports that the Social Security Administration no longer plans to cut the number of people who are eligible to receive disability benefits.

- New York Police Department Commissioner Jessica Tisch said she will stay in the job when Mayor-elect Zohran Mamdami takes office.

- The House unanimously passed a bill repealing a provision from the shutdown-ending legislation that allows senators to sue the government for $500,000 if their phone records were subpoenaed or obtained without notice.

- Billionaire environmentalist Tom Steyer announced he’s running for California governor.

Around the World:

- An Argentinian congressional investigation accused President Javier Milei of potentially committing “alleged fraud,” connected to his social media posts promoting a little-known cryptocurrency.

- China suspended seafood imports from Japan in retaliation for Japanese Prime Minister Sanae Takaichi’s comments implying that Japan would defend Taiwan from invasion.

- The U.S. approved a deal to sell tens of thousands of AI chips to the Middle East, reversing previous policy.

On the Money:

- TikTok parent company ByteDance reached a $480 billion valuation this morning after a Chinese venture firm purchased a stake in the company at a share auction.

- Target reported a continued sales decline in its Q3 earnings, with same-store sales falling 2.7 percent, and expects to see further decline in Q4, despite the holiday shopping season. Target also announced a partnership with OpenAI, allowing ChatGPT to search for products and add them to cart within chats.

- Adobe acquired digital marketing and SEO optimization platform Semrush for $1.9 billion.

Worth Your Time:

- “America’s Kids Can’t Do Math Anymore” (The Atlantic)

- Alvin Chang breaks down every time that “democracy” has been said or written into the Congressional Record since 1880. (Pudding)

- Friend of TMD Kara Kennedy on the cast of Wicked looking unsettlingly thin. (The Free Press)

- Rebecca Cairns reports on how new technology is helping conservationists track and count the rare African golden cat. (CNN)

- Tyler Cowen interviews Blake Scholl, CEO and founder of aircraft startup Boom Supersonic. (Conversations with Tyler)

- Charlie Jane Anders on the science-fiction and fantasy novels released this year. (Washington Post)

Presented Without Comment

The Guardian: January 6 Rioter Who Was Pardoned by Trump Arrested for Child Sexual Abuse

Also Presented Without Comment

Bloomberg: Fugitive Olympic Snowboarder Indicted on Murder, Drug Charges

A Canadian former Olympian accused by the FBI of running one of the world’s largest cocaine networks now has a $15 million bounty on his head. Federal officials said Ryan James Wedding, once a snowboarder at the 2002 Winter Games in Salt Lake City, built a billion-dollar drug enterprise with Mexico’s Sinaloa cartel and ordered the murder of a witness in Colombia.

Also Also Presented Without Comment

Strait Times: Dog Swept Away by Flood in Central Philippine Finds Way Home Two Weeks Later

Let Us Know

Have any thoughts or questions about today’s newsletter? Drop us a note in the comments or by emailing us at tmd.questions@thedispatch.com. We read every submission, and your message could be featured in an upcoming “Behind the Scenes” segment.

Have any thoughts or questions about today’s newsletter? Become a member to unlock commenting privileges and access to a members-only email address. We read every submission, and answer questions in the following edition of TMD.

Correction, November 20, 2025: This newsletter has been updated to correct the size of the fall in the value of Bitcoin.

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.

With your membership, you only have the ability to comment on The Morning Dispatch articles. Consider upgrading to join the conversation everywhere.